FOREX

The US dollar surged, reaching heights not witnessed since last November, after yesterday's US inflation report not only validated but surpassed expectations, underscoring the persistent inflationary pressures gripping the world's largest economy. This development effectively quashed speculation of a rate cut in June and cast doubt on the likelihood of any monetary easing by the US central bank this year. With September emerging as the probable timeframe for the inaugural rate reduction and analysts predicting only two such cuts in 2024, treasury yields climbed, and the US dollar recorded gains against other major currencies. Moreover, there exists the potential for further appreciation, particularly if today's release of Producer Price Index figures confirms the entrenched nature of price inflation in the US.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

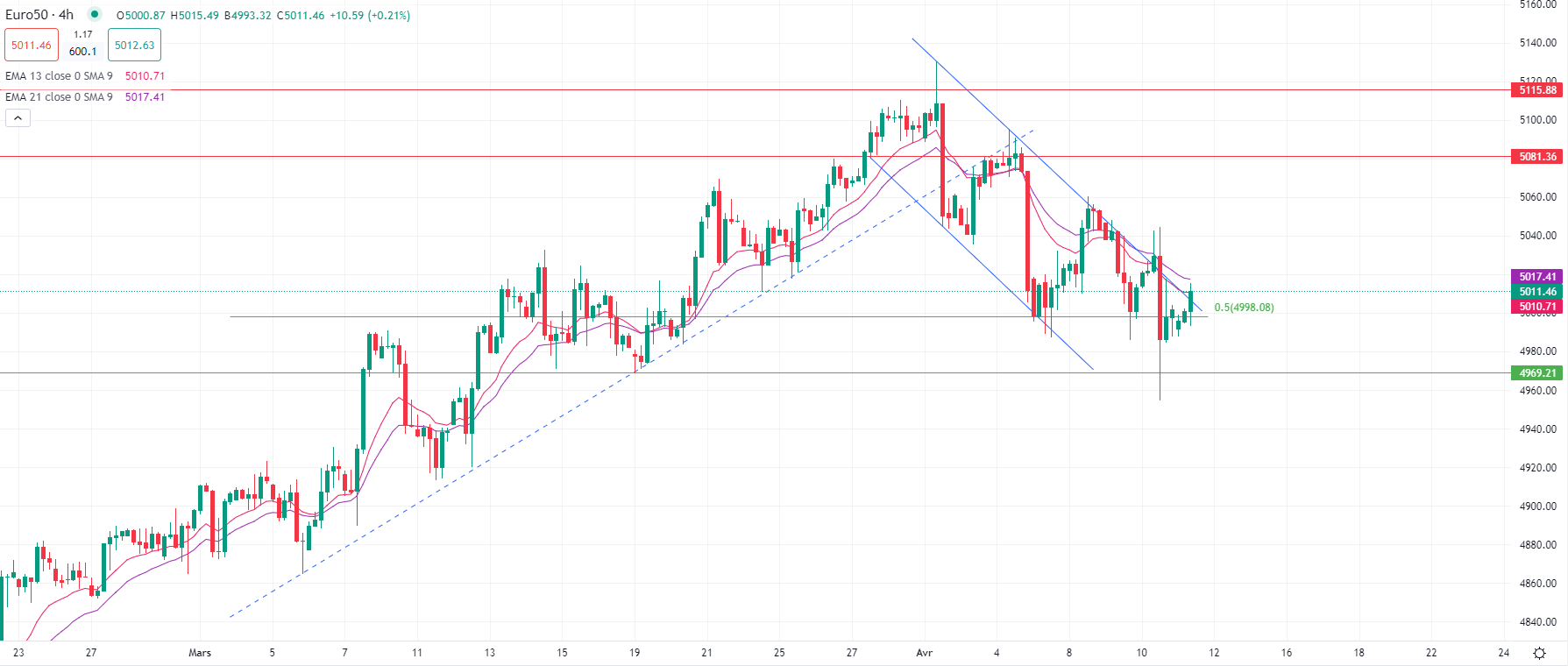

Stocks climbed in Europe on Thursday, paring some of yesterday's losses sparked by a disappointing US inflation report. Investors' focus now switches back to Europe with a looming decision on rates from the ECB.

Yesterday's higher-than-expected US inflation data caused havoc for riskier assets, with volatility spikes on almost all equity benchmarks, from Tokyo to New York.

Indeed, the recent batch of solid economic data showing a resilient US economy, combined with the fact that the fight against inflation isn't over yet, has pushed traders to scale back hopes of rate cuts.

With the prospect of a less accomodative approach from the Fed, investors who were already struggling to defend high valuations on stocks, have naturally chosen to decrease their exposure to equity markets, leading benchmarks into correction territory.

That said, calm has quickly returned to EU stocks, as investors are now eyeing the ECB's next rate decision and press conference, which is due at the beginning of the afternoon.

While no rate move is expected at today's meeting, investors already anticipate ECB President Christine Lagarde confirming a potential first cut in June while providing more details on the strength and pace of the next monetary moves.

Unlike the US, the Eurozone's inflation rate is much closer to the 2% target, and the region's weaker economic fabric tends to support hopes of a quicker dovish switch from the ECB than the Fed.

The STOXX-50 still trades above the 5,000pts level following a successful rebound over 4,970pts, which has been mostly led higher by energy shares.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.