In June last year I wrote about why the stock market and the economy were two separate and very different things.

The thrust of this article was to highlight the divergence between the performance of Europe's stock markets and its major economies, which were heading in opposite directions, and to question whether that divergence was justified.

See: The stock market and the economy are two separate things

European equity markets have made further significant gains over the last 9 months the Dax has added more than +13.0%, since then for example.

How can we explain that?

Well two factors account for a large chunk of those gains:

Major European indices are made up of exporters-stocks that often earn their living from outside of Europe.

And which to some extent are insulated from many of its economic woes and structural issues.

In fact as with Japan, a weaker currency can actually benefit those exporters.

The second factor at play is the fact that European equities are far cheaper, or at least, are trading on far cheaper multiples, than their US peers. And that keeps attracting traders and capital flows to European stock markets.

The are also some fairley unique stocks, or stocks with unique propositions, in Europe, such as LVMH, ASML, Novo Nordisk to name just three.

Economic sentiment

I am not the only one thinking about this ongoing divergence between European equities and their underlying economies.

BNP Paribas recently published notes on the economic outlook one of which looked at Europe.

It was packed with data and charts but I have tried to summarise it below:

1. Eurozone: Economic sentiment is expected to deteriorate gradually, with manufacturing being the main concern. Consumer confidence and retail sales are projected to remain subdued.

2. Germany: The manufacturing sector faces difficulties, from a declining business climate and weaker new orders. Construction is expected to perform better than other sectors.

3. France: After a difficult first quarter, a delayed recovery is anticipated.

Retail sales and employment are forecast to improve, while inflation is expected to decline.

4. Italy: The manufacturing situation continues to deteriorate, with export orders and employment in the sector creating challenges.

5. Spain: Spain is projected to lead the way in Southern Europe, with relatively better performance in services and consumer confidence.

Overall, the note highlights the challenges faced by the manufacturing sector across multiple economies, while services and construction are expected to fare better.

Inflation is projected to continue ease, but consumer confidence and retail sales are likely to remain subdued in several regions.

These last points are the ones that took my eye, because manufacturing is still very important to several European economies.

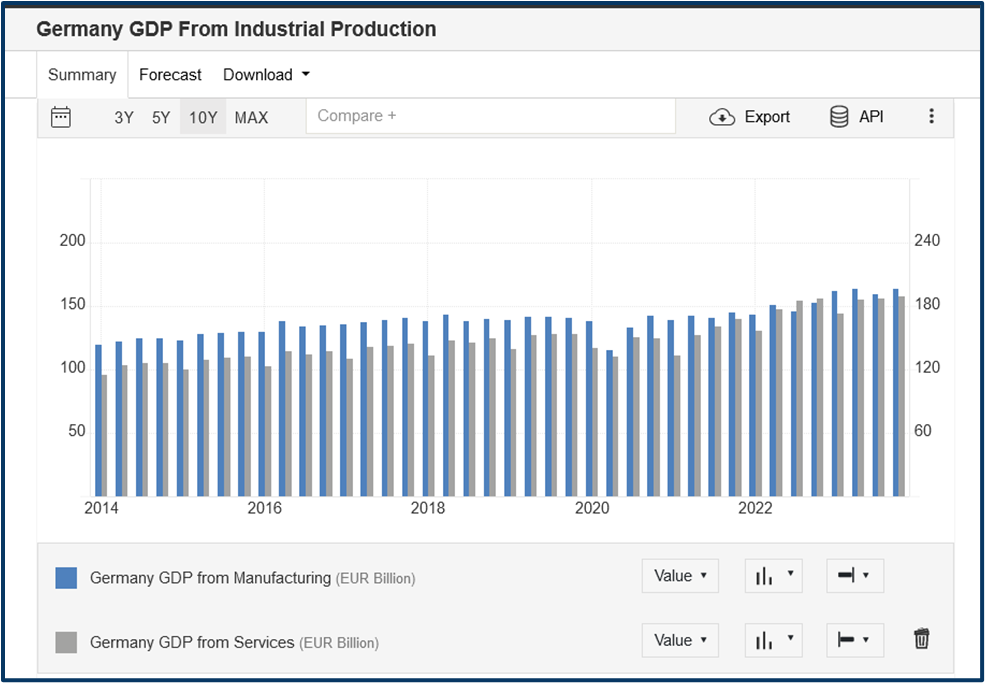

In Germany for example, it's still the largest part of the economy when meaured by the GDP produced by it

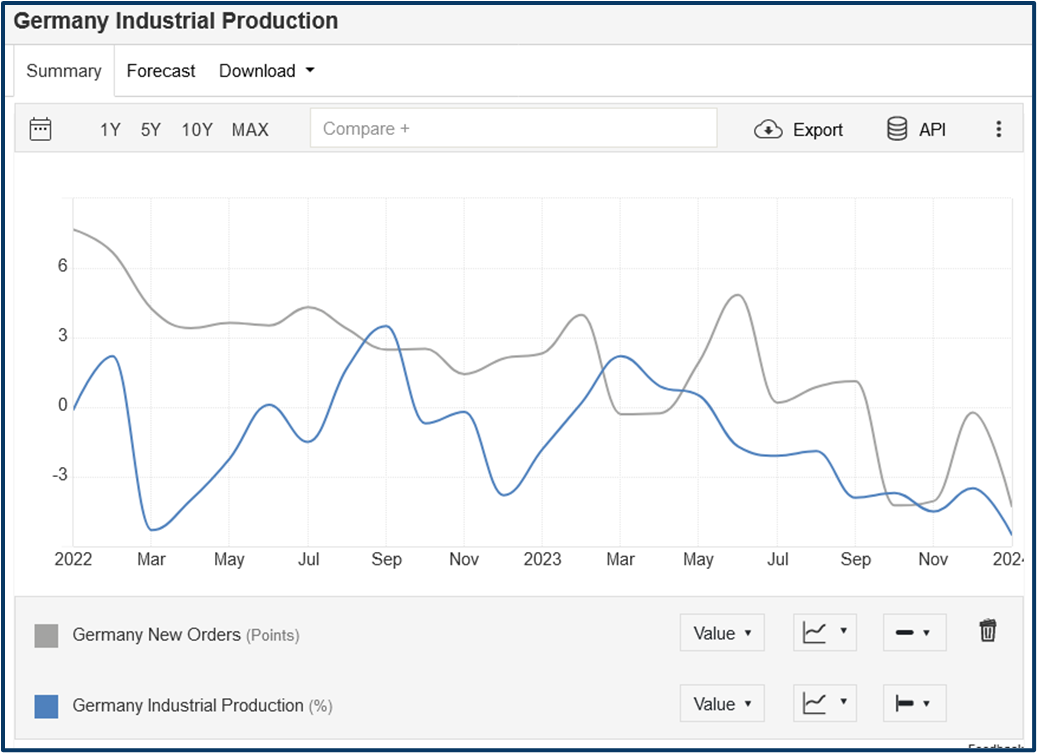

Worryingly German industrial production and new orders have both been falling as we can see below.

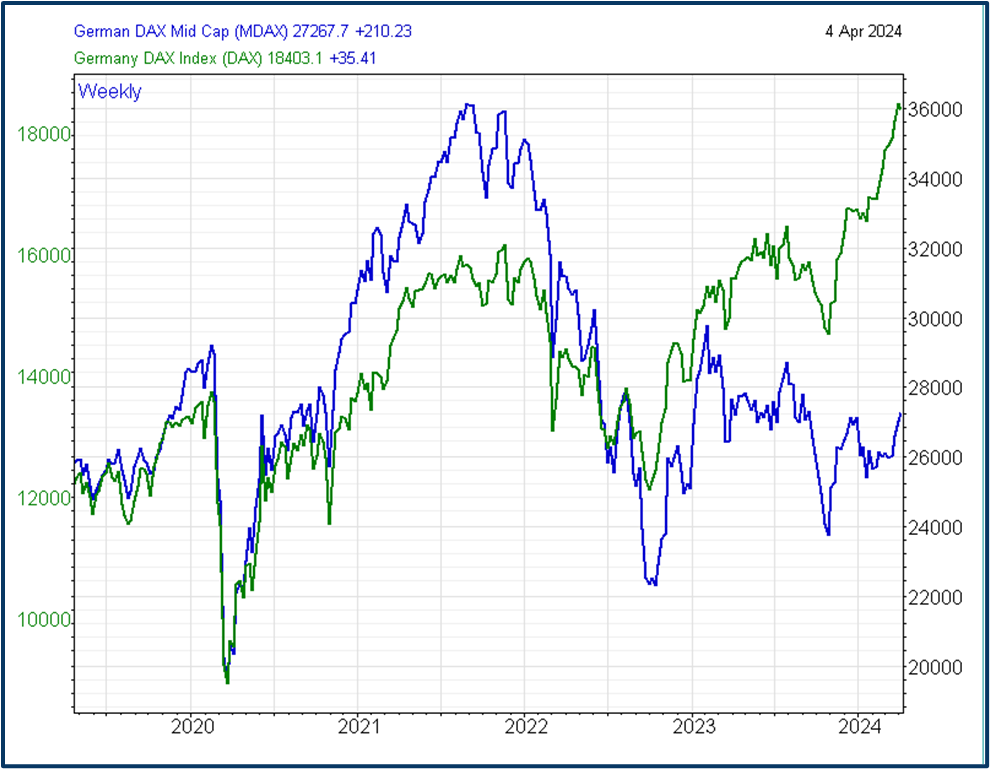

Despite that the DAX 40 index continued to move higher.

Though its interesting to note the MDax the German Mid-cap index, drawn in blue, below hasn't enjoyed the same kind of rally as its large cap peer.

Just this week we saw the release of German export data for February. The data showed a bigger drop than anticipated, with exports falling by -2.0% versus forecasts for a -0.50% drop, according to Reuters.

The larger than expected fall came about because exports from Germany to other EU members declined falling by almost -4.0% on the month.

Exports to China also fell but by a far smaller -0.60%.

The one bright spot was a 10.20% jump in German exports to the US, during February.

The chart and table below shows us who Germany's major export partners are, based on 2023 data.

The US is top dog but we only we need to look at the pie chart and league table to see how important other EU markets are to the German export economy.

Are the cracks beginning to show?

In recent sessions the DAX 40 has started to weaken, as have Italian, French and Spanish equities.

Could the market now be having some doubts about the wider European economy? And the ECBs ability to manage it?

There have been calls for interest rate cuts in Europe throughout 2024 but as yet the central bank hasn't delivered any.

Expectations are focused on June, as inflation has fallen closer to the ECBs 2.0% target

There is also a debate about how many additional rate cuts, could be expected to follow, a -0.25% reduction at the June policy meeting? (should that go ahead).

If the bank cuts too frequently might that be taken as a sign of concern about economic growth in the single market?

After all composite PMIs for the Eurozone have only just edged back in to positive, or expansionary territory above 50.00, after 8 months of contraction.

Something to think about isn’t it ...

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.