GOLD

Gold prices hit a fresh all-time high during early Tuesday trading, driven by a surge in haven demand. Iran's explicit threat of military retaliation following Israel's targeting of its Syrian embassy has escalated tensions, amplifying the spectre of a broader regional conflict with potentially unforeseeable repercussions. Concurrently, the ongoing conflict in Ukraine exacerbates investor anxieties. Against this turbulent backdrop, the imminent release of US inflation data and the latest FOMC minutes on Wednesday loom large, poised to either fuel the gold frenzy or temper its ascent, depending on the clues they may leave regarding the Federal Reserve's anticipated timing for its first rate cut.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

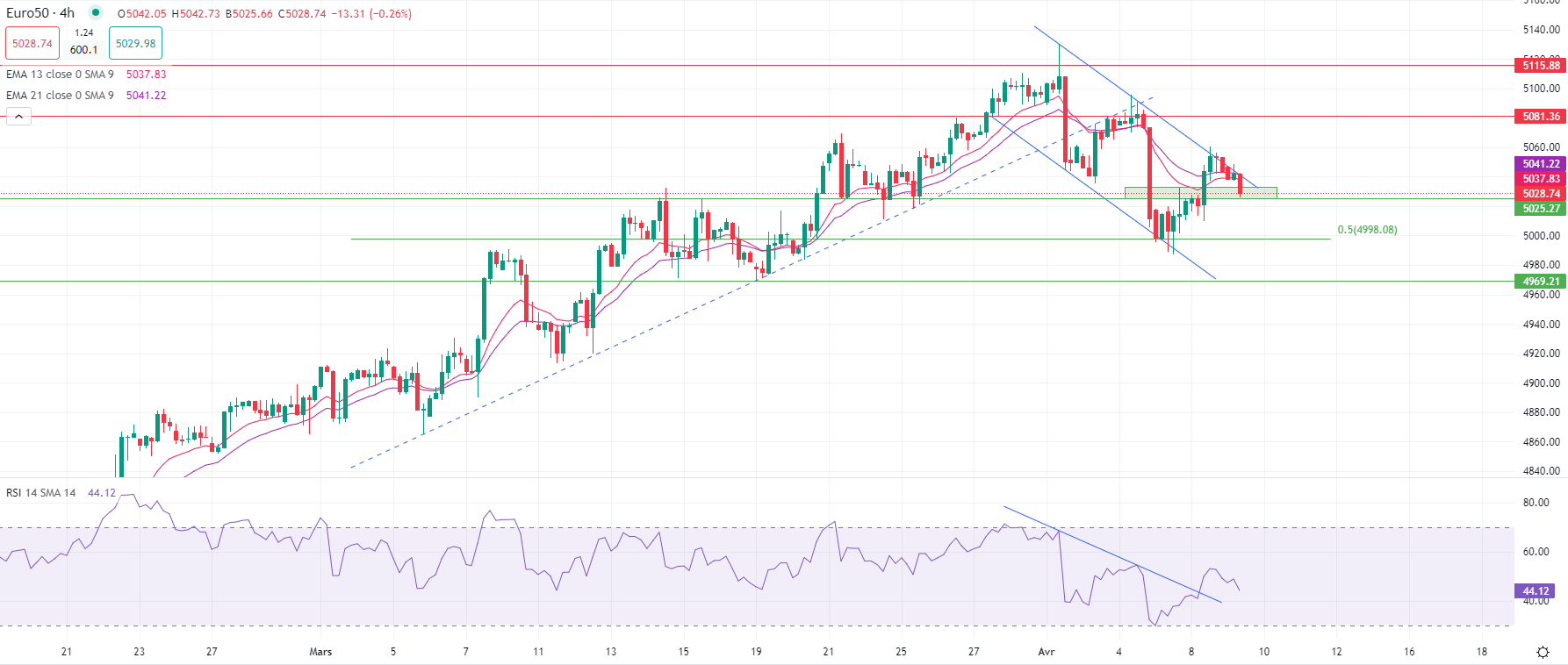

Most stocks traded slightly lower in Europe on Tuesday, paring some of yesterday's gains as the "wait and see" stance seems to prevail ahead of tomorrow's US inflation data.

Volatility is decreasing, and market sentiment is muted as investors avoid any risk exposure before this week's crucial data releases.

Tomorrow's US CPI report will likely provide traders and analysts with more clues about when the Federal Reserve may start lowering borrowing rates. This should shape short- to mid-term market sentiment across a wide range of assets, including treasuries, forex, and equities.

Meanwhile, sharp and directional price actions are unlikely, especially as no significant data is expected in today's agenda.

Most EU benchmarks are currently testing freshly established short-term floors, and the STOXX-50 currently trades around the 5,025.0pts/5,032.0pts support zone, as good performances from mining and energy stocks, due to a surge in prices in iron ore and oil, get offset by losses in all other sectors.

A break-out of the 5,025.0pts level by the STOXX-50 index could open the way to a deeper correction, back to the 5,000.0pts zone, even if this scenario isn't the most likely so far.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.