The last few years in the equity markets have been about size, there is no getting away from it.

The growth and price performance in stocks like Nvidia NVDA US,have driven US equity markets to uncharted levels, and on the way thorough have provided the media and market commentators like myself with endless soundbytes and compassions.

Such as Nvidia’s market cap is bigger than the entire FTSE 100,and Nvidia's CEO, Jensen Huang is, on paper at least, personally worth more than the market cap of Intel INTC US.

But as we noted recently in the article sources of return, over the last three months size hasn't counted for much, as far as index performance and returns are concerned.

Of course, the attractions of large cap equity trading are not going away any time soon, but it would be nice to think that the other, 490 odd stocks, in the S&P 500 might get a look-in before year end.

It's tough to outperform

S&P Dow Jones Indices has recently published its SPIVA Global Scorecard report, which tracks the performance of actively managed funds around the world, versus their relevant benchmarks.

Something it's done for 20 years or more.

The overall findings in the report are not too surprising, it’s hard, and getting harder to outperform a benchmark, as an active manager, and almost impossible to do that consistently, over an extended period of time.

The Global Scorecard examined the performance of more than 8400 active funds and found that 64% of those had underperformed in the first half of 2024.

Global Equity funds were some of the worst performers with as many as 78% of those in this category failing to beat their respective benchmarks.

It’s not just funds that underperform

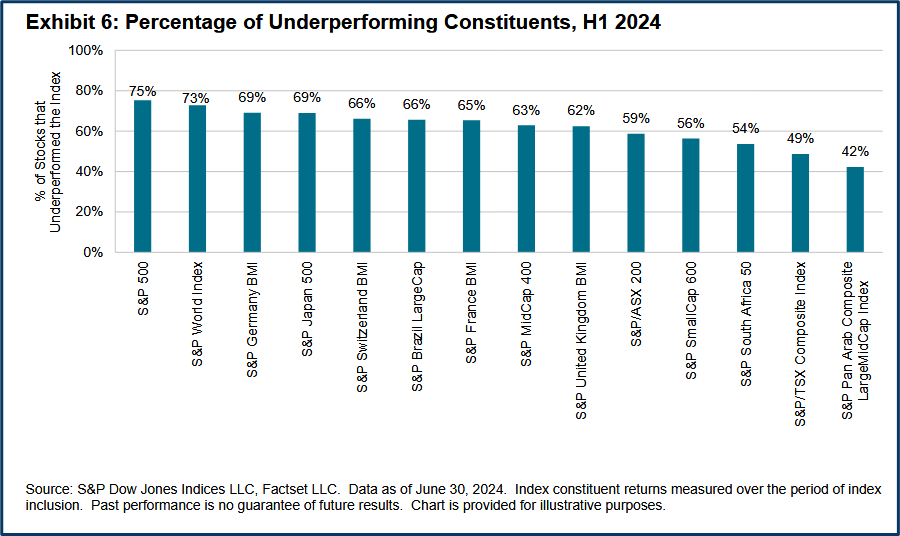

We can get an idea of how hard it is for active managers to beat their index benchmarks from a chart like this, which shows the percentage of stocks within an index that underperformed in the first 6 months of 2024.

Source: SPIVA Global Scorecard Report H1 2024

75.0% of stocks in the S&P 500 underperformed the blue chip index during H1 20024.

That means that just 125 stocks within the index either met or beat the index performance.

That might sound like a lot but when it comes to portfolio construction, the more stocks that you can choose from the better.

It also means that the managers had only a 1:4 chance of picking a winner, and that's before we consider any restrictions related to items like market cap, free float or average daily volumes etc.

It get better as you move away

Interestingly if we move away from US large caps, then the underperformance percentages start to tail off.

In the UK for example just 62% of stocks underperformed the S&P UK Broad Market Index, and in Canada only 42.0% of large caps did worse than their benchmark.

It's not just geography that seems to make life a bit easier for active managers, size also seems to matter.

I say that because in the S&P 400 Midcap index only 63% of stocks underperformed.

And according to the SPIVA data, 85.0% of all US based active Small Cap funds, outperformed the S&P 600 Small Cap index, in the first half of 2024.

No doubt much to the envy of their large cap peers.

Different concerns

Of course as individual traders we are not necessarily concerned with our performance versus a benchmark.

Insteadour focus is likely to be on win loss percentages andthe risk reward ratios in our trades.

Trying to steer ourselves more towards wins and rewards, and away from risk and loss.

However we mustn't lose sight of the factthat there is a world beyond the headlines and story stocks that monopolise the media. You could argue quite forcibly that it could be better to avoid these types of stocks, or least to not become hooked on them, because there are plenty of opportunities to be found elsewhere

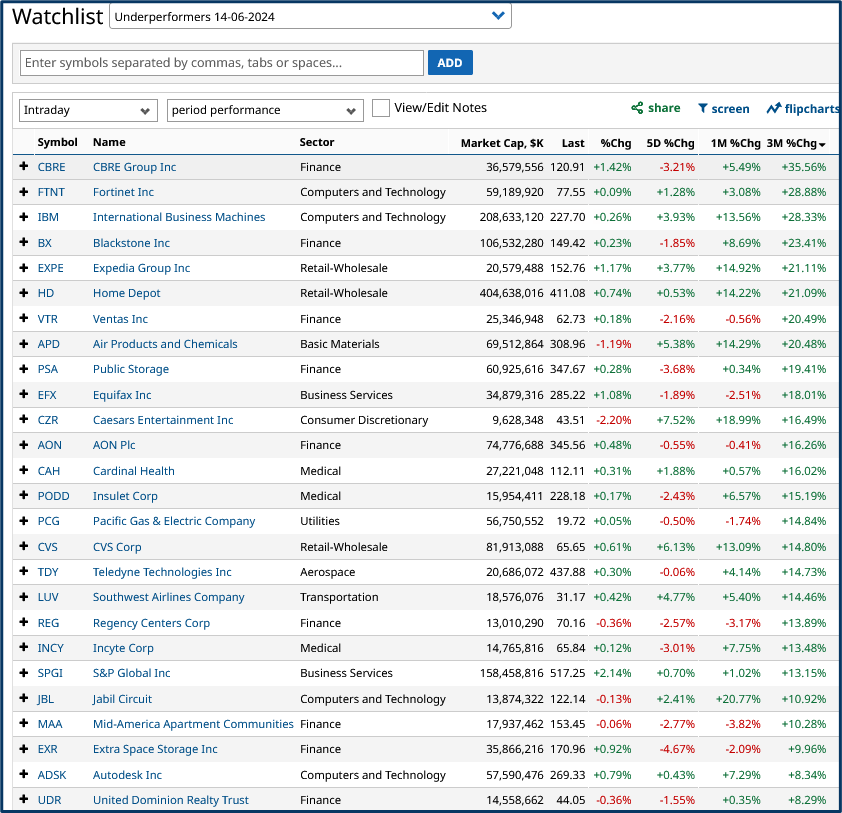

For example, here is part of a list of underperforming stocks that I created on June 14th.

They are ranked by their 3-month % change.

There are 39 stocks in all in the list (I haven't shown them all) and as you can see many of them have gone on to produce decent returns over the last 3 months.

During which the S&P 500 has returned just +2.60%. By comparison sleepy old IBM has rallied by more than +28.0% at the same time.

Source: Barchart.com

Not every one is a winner but the majority are

Not every stock in the list has fared so well, of course. There are 10 names that are down over three months. The biggest loser, Humana HUM US, has lost almost -35.0% since July.

However, the winners far outweigh the losers, and that is the situation that successful traders strive for every day.

As i have said before, following the crowd, or using them to your advantage in momentum trades is great. But so is thinking outside the collective box and looking for your own opportunities, which is what I did with the list above.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.