I am going to stay with a theme that I picked up on last week and that is the contradiction between how the market was thinking in early August, and the reality of earnings and economic data, that we have since then.

None of which appears to support the idea of a US recession.

I am not alone in thinking this.

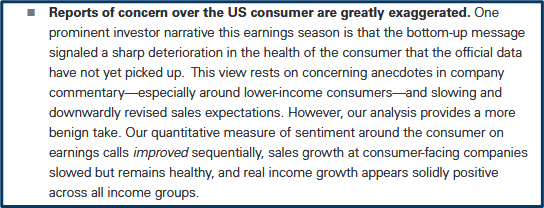

The Goldman Sachs US economics team recently published a note in which they looked at Q2 earnings season in the US.

It's interesting to get the perspective of the economists, who spend much of their time thinking about the markets from a top-down/biggest-picture perspective.

This comment stood out to me:

Source: Goldman Sachs Research

Goldmans US economists believe that the US consumer is in much better health than some would have us believe a view that was borne out by the large beat in retail sales last week and the blowout earnings reported by Walmart WMT US.

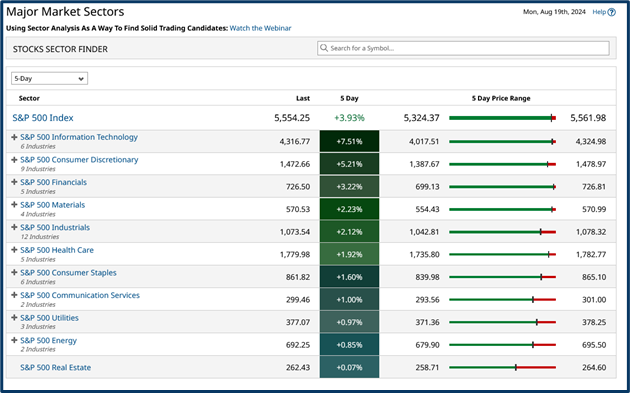

The S&P 500 Consumer Discretionary sector was the second best-performing cohort over the last week, and the S&P 500 index itself, is now just 2.0% away from its all-time highs.

Source: Barchart

Consuming Technology

Only Information Technology stocks outperformed the Consumer Discretionary sector last week.

One of those was Micron Technology MU US which I highlighted as an example of what to look for in an underperforming stock in Part One of this short series of articles.

Interestingly Micron has rallied +16.0% over the last week so it sounds like we were looking for opportunities in the right places.

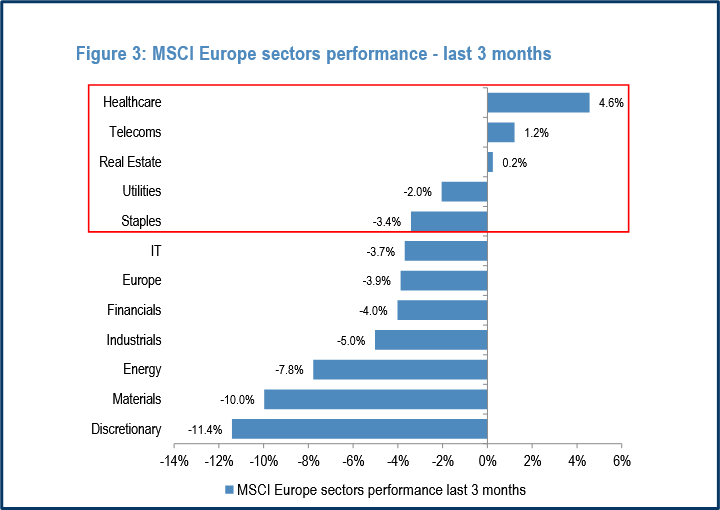

Goldman wasn't the only bank to put pen to paper in recent days JP Morgan Equity Strategy team looked at the difference between US and European equity markets and what the benefits were, if any of listing in one rather than the other.

JPM Said that “Eurozone equities have stalled since March” Something that's pretty evident in the chart below.

Consumer Discretionary is Europe's hardest hit sector according to JP Morgan data.

Source: JP Morgan Research

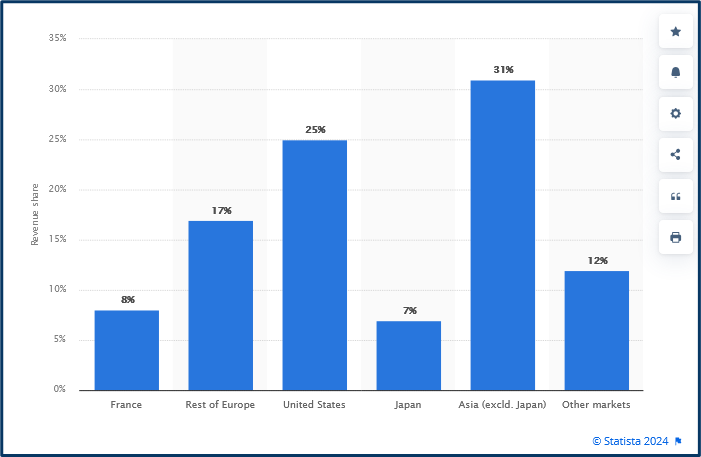

LVMH MC FP is the leading European luxury goods brand it's also one of the biggest constituents of the Consumer Discretionary sector in Europe.

The LVMH share price has fallen by -19.50% over the last six months, on concerns about slowing demand for its products, particularly in China, its largest market.

However, I can't help but notice that the United States, is the second largest marketplace for the company, based on revenues, as we can see in the chart below.

Revenue share of the LVMH Group worldwide in 2023, by geographic region

Source: Statista

So could an improving outlook for the US consumer/economy lead to a re-rating or reassessment of the prospects for LVMH’s stock price?

Source: Barchart

“One swallow does not a summer make” of course, but it’s something that I will be keeping and eye on from here.

And of course, LVMH is not alone in having suffered a sharp share price drop - rivals Kering and Burberry have both been hard hit in 2024.

Auto-renewal

You may recall that I shared a table of underperforming US Consumer Discretionary stocks, and their performance over the last month, in part one of “Where to look now”.

That table was topped by Ford Motor Company F US which at the time was down by -27.0%.

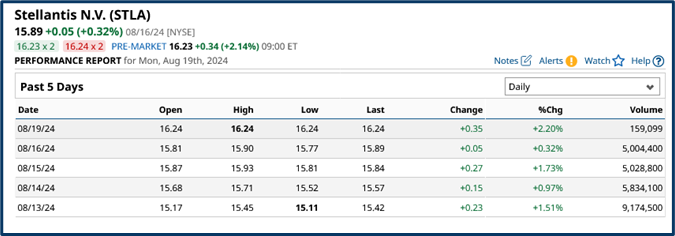

European Autos have also suffered in 2024 none more so that Stellnatis STLA US the Euro- American car maker is the home of brands like Chrysler, Fiat, Alfa Romeo, Jeep, Citroen and Vauxhall.

The stock price is down by -20.00% in the last month and almost -37.00% over the last 6-months.

However, the stock looks to be on course for five consecutive, positive sessions.

Source: Barchart

The chart looks interesting too, though clearly sentiment towards the stock will need to improve dramatically if the share price is to retrace its 2024 losses.

Source: Barchart

It's another example of the kind of opportunity that I am on the look out for and how I try to knit together a narrative from various sources, which could create a change in sentiment. In the end, this is what drives price appreciation/ depreciation.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.