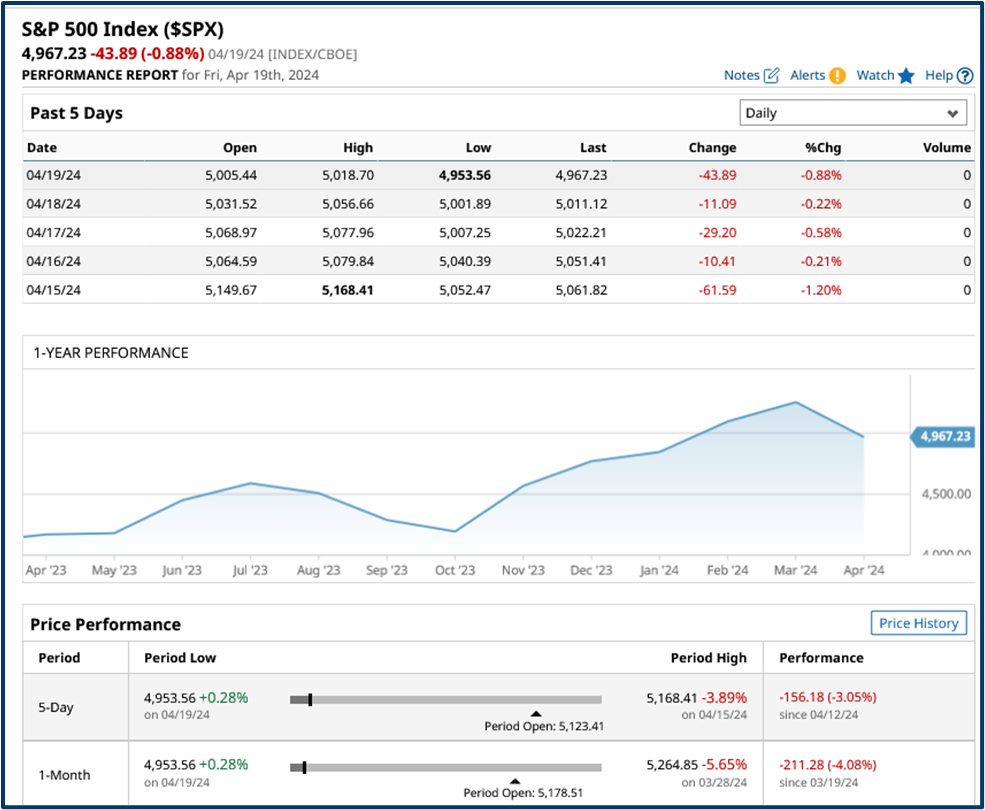

Over the last 4 weeks, we have seen a sell-off in US equities, with the S&P 500 index losing -4.08%, as of the close on 19/04/2024.

Whilst Nvidia NVDA, the talisman for the AI fuelled equity boom, has lost - 14.76%, and most of that in one session.

At best the recent index move is a much-needed pullback.

At worst it could turn into something more substantive, perhaps even a full-blown correction.

Source: Barchart.com

That’s not my current expectation however. Though I do think we could see another- 200 or even -300 points knocked off of the S&P 500 from here.

With that in mind, I thought it might be instructive to look at the causes of larger market corrections, because, once we know what they are, we stand a much better chance of being able to identify them.

Cycles

The stock market moves in cycles of rallies and corrections.

There is no standard definition of what constitutes market correction however it is often used to denote a decline in stock prices of -10.0% or more, from the recent highs.

While market corrections can be very unnerving for traders and investors, they are a normal, healthy part of the market cycle.

Not least because they cull extreme and over-leveraged positioning and allow excessive valuations to normalize.

Several potential catalysts can trigger a stock market correction:

Interest Rate Hikes

When the Federal Reserve and other central banks raise interest rates, it makes borrowing more expensive for both consumers and businesses.

This increased cost of capital can slow economic growth and negatively impact corporate profits.

Stock valuations are closely linked to earnings potential, so rising rates can deflate stock prices.

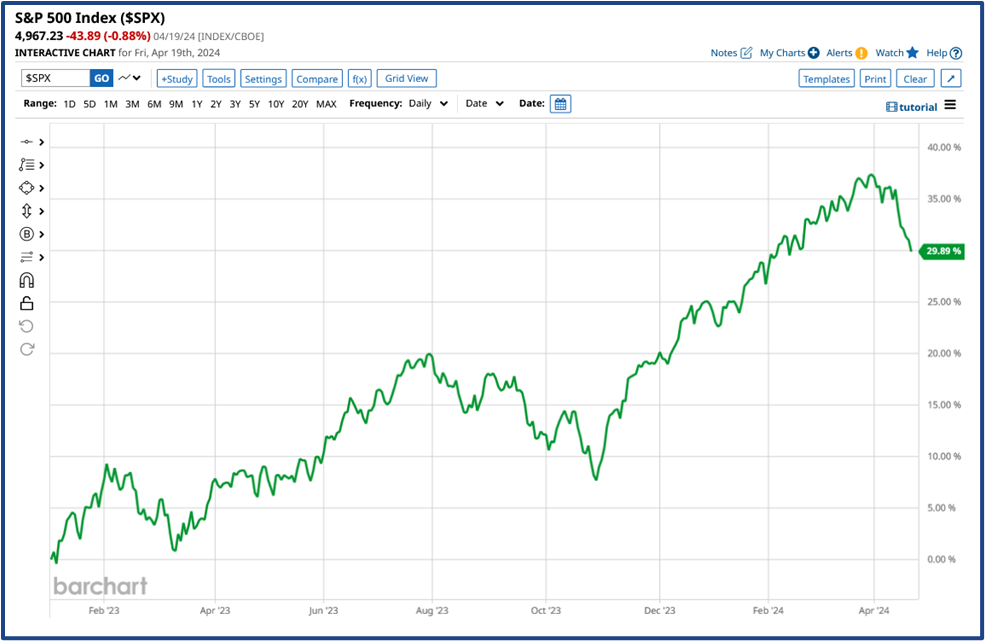

Equities ran up sharply in 2023 on expectations of interest rate cuts. However we are now almost four months into 2024 and the Federal Reserve, the BOE and the ECB, have yet to cut their interest rates.

Source: Barchart.com

Inflationary Pressures

Interest rates have remained “high” because the inflation won’t lay down and die.

At least not in the core measures that the Federal Reserve monitors closely.

Higher rates of inflation can erode corporate profit margins and push up input costs, such as labour, raw materials, energy transport etc.

Inflation also erodes consumers purchasing power, at the same time as it drives prices of goods and services higher.

In these circumstsances household budgets can be squeezed, and consumers may have to cut back on luxury and discretionary items.

Something we discussed recently in The Importance of Defensive Stocks and Sectors.

Changes in consumer spending patterns matter because personal and household consumption is responsible for as much as 70.00% of US GDP.

Elevated Inflation, or inflation thats remains “higher for longer” often prompts more aggressive action from central banks, whose remit is to control excess demand and price growth.

At the moment the market has been “happy” enough to push back on the timing and frequency of rate cuts in the US. However there have been whispers about the possibility of the next move in rates being a hike.

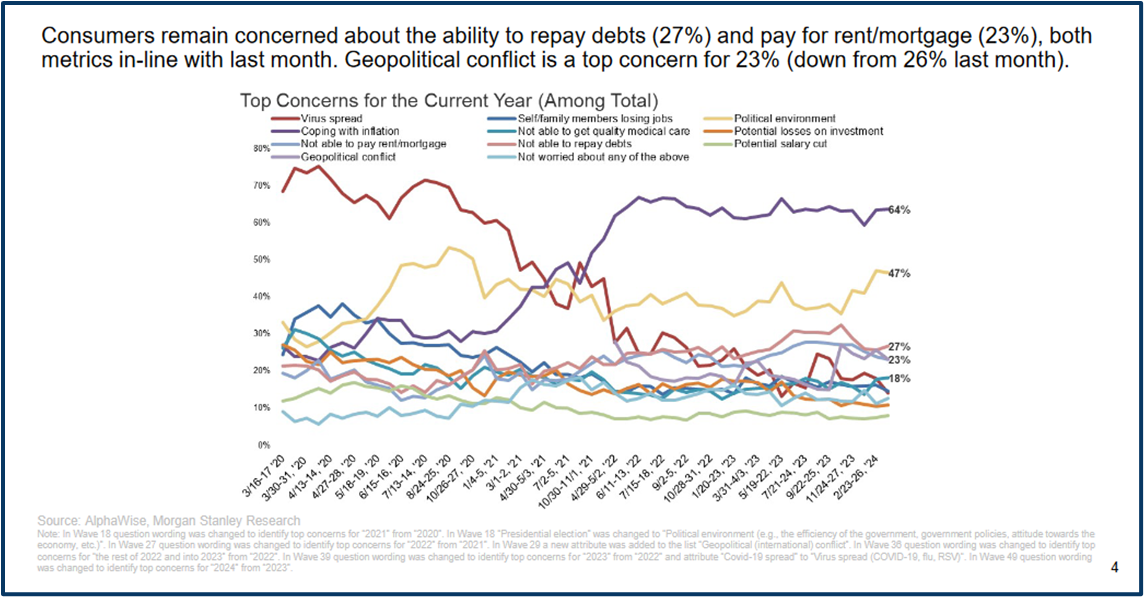

Morgan Stanley recently surveyed 2000 US consumers about their attitudes, spending plans and concerns

Source: Morgan Stanely Research

Geopolitical Tensions

Wars, political instability, terrorist attacks or other major geopolitical events can roil markets due to increased uncertainty around economic and trade policies. This risk-off sentiment can spark a flight to safer asset classes.

We have two ongoing regional conflicts right now both of which could esclate both in terms of geography or intensity for now at least it appears that Israel and Iran will not enagage in an all out war with each other though the iranians are likely to continue to attack Israel through their proxy armies in Lebanon and Syria.

The war in Ukraine shows now signs of ending and more recently Russia seems to have been gaining the upper-hand, though additional funding for Ukraine, from the US, may help to redress that balance.

Overall markets have taken these regional conflicts in their stride. Perhaps because they haven’t directly affected the daily lives of citizens in the developed world, but of course that could change very quickly if either of both of these conflicts esclated.

The VIX index (green) versus Brent crude (red) YTD - A measure of the markets attitudes to risk.

Source: Barchart.com

Recession Fears

If key economic indicators, such as an inverted yield curve, declines in manufacturing output, or rising unemployment,start signalling a potential recession, it can dampen investor sentiment and stock demand.

Recessions often correspond with contractions in corporate earnings.

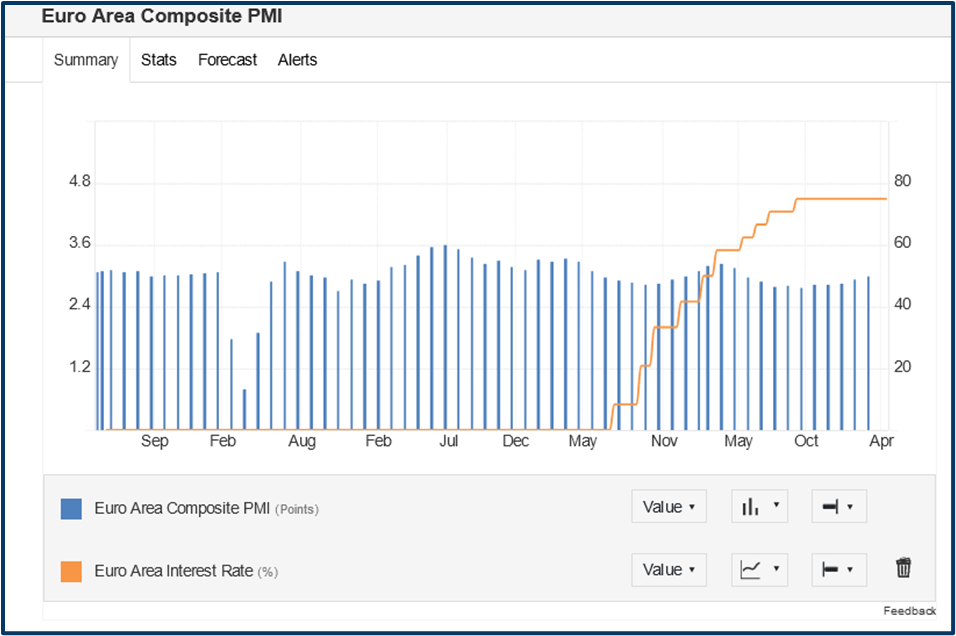

We had our share of recession concerns in 2023, however, for the US at least, these have now been discounted. The situation in mainland Europe is not so clear cut however.

Almost everyone expects the ECB to start cutiing its interest rates from June to boost the Eurozone economy.

Then again some people were predicting as many as seven US rate cuts in 2024, that forecast has now been trimmed to as low as one.

Eurozone composite PMIs have only just edged back above 50

Source: Trading Economics

Asset Bubbles Bursting

When investor psychology drives asset prices to levels that are detached from their intrinsic values, a correction becomes inevitable.

Tech stock bubbles and housing bubbles are typical examples of this phenomenon.

We haven’t seen this kind of behaviour in the current cycle. Though Nvidia’s NVDA, -10.00% correction on the 19/04/24 gave us a flavour of what this might look and feel like.

Black Swan Events

"Black Swan" events, or unkown unkowns, are events that are extremely difficult to predict, such as the 2020 COVID-19 pandemic.

Such events can create a severe market selloff.

These unforeseen systemic shocks can completely disrupt normal economic conditions for an unspecified period of time. Markets hate uncertainty and while it perists prices abd valuations can come under intense pressure.

History shows that market corrections are temporary, and the overall trend of the stock market has been upward over time.

However we shouldnt rest on our laurels. We should always expect the unexpected and build those worst case scenarios into our risk profiles and positioning accordingly.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.