While gold has been valued for centuries as a precious metal, gold is enjoying something of renaissance as a financial asset and has recently printed at new all time highs.

So just what are the attractions of Gold and why has it become popular once more?

Below, we examine the case for gold that so called “gold bugs” tend to advance when they are pushing the yellow metal. (which in my experience is any chance they get)

A Hedge Against Inflation

One of the reasons that some traders love gold is because they view it as a hedge against inflation and economic turmoil.

When national currencies experience inflation and decline in value, gold has historically maintained its purchasing power.

Gold bugs maintain that trading/ owning gold can protect the real value of your portfolio during inflationary times.

However on closer inspection this hasn't always been the case.

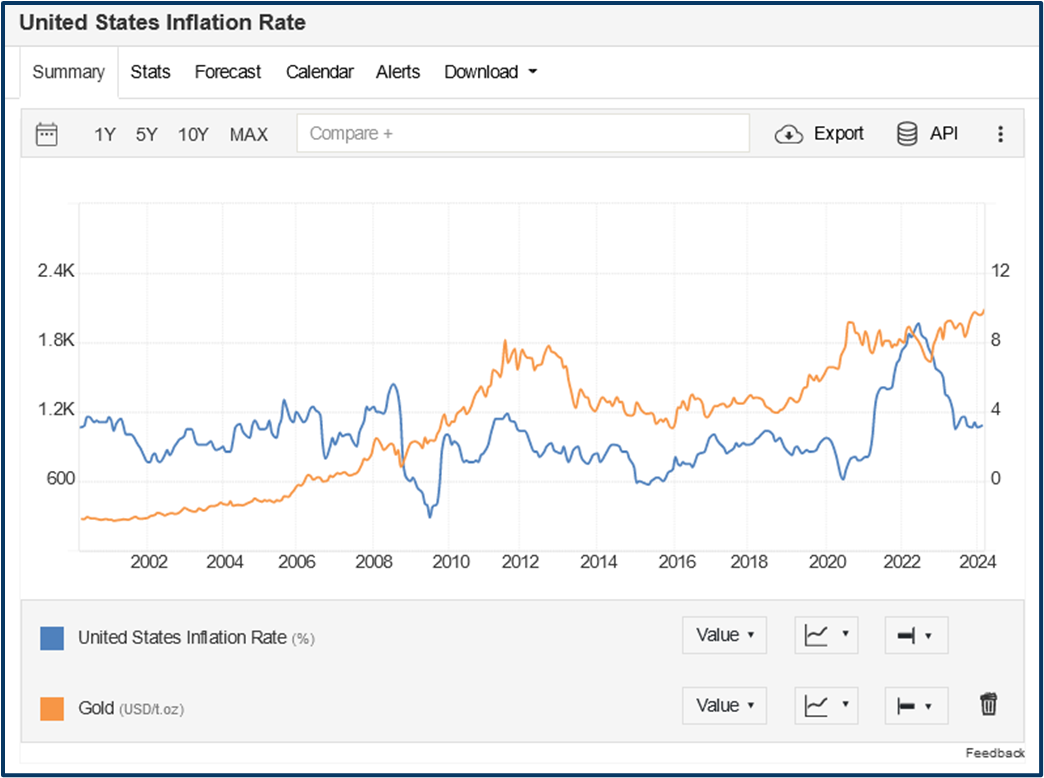

For example in this chart, which plots spot gold against the inflation rate in the US, we can see that, on several occasions, gold appreciated in value when US inflation rates were falling.

Source: Trading Economics

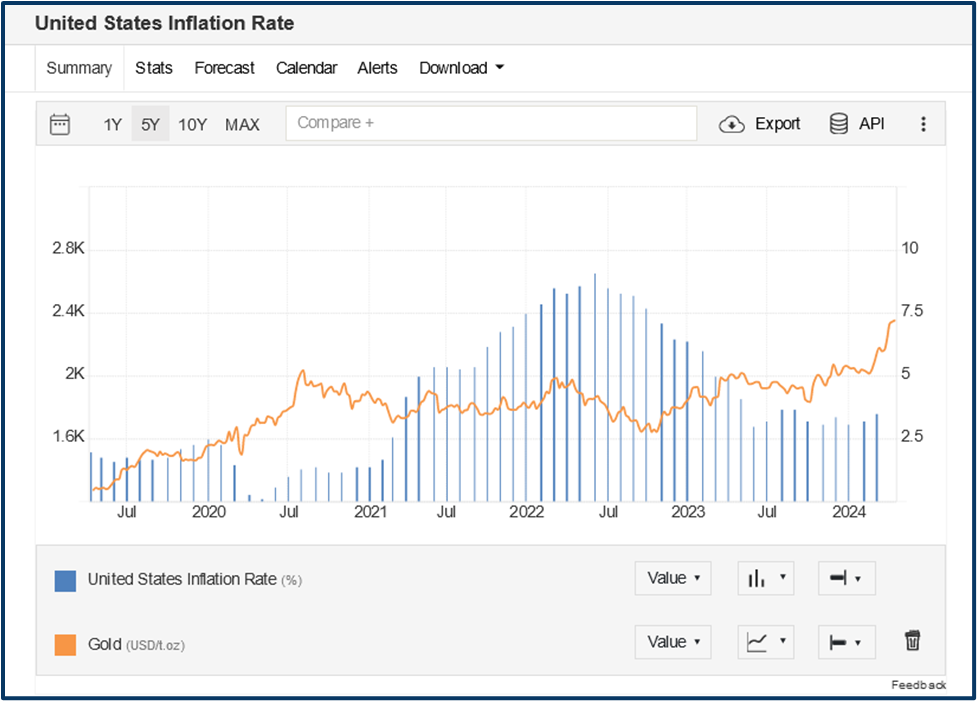

And if we zoom in on the chart, we find that the gold price barely moved when US inflation spiked sharply, post Covid.

Source: Trading Economics

Portfolio Diversification

Gold prices tend to move independently of other asset classes such as stocks and bonds.

This low correlation means adding gold to a portfolio can provide diversification and act as a store of value.

This tends to ring true.

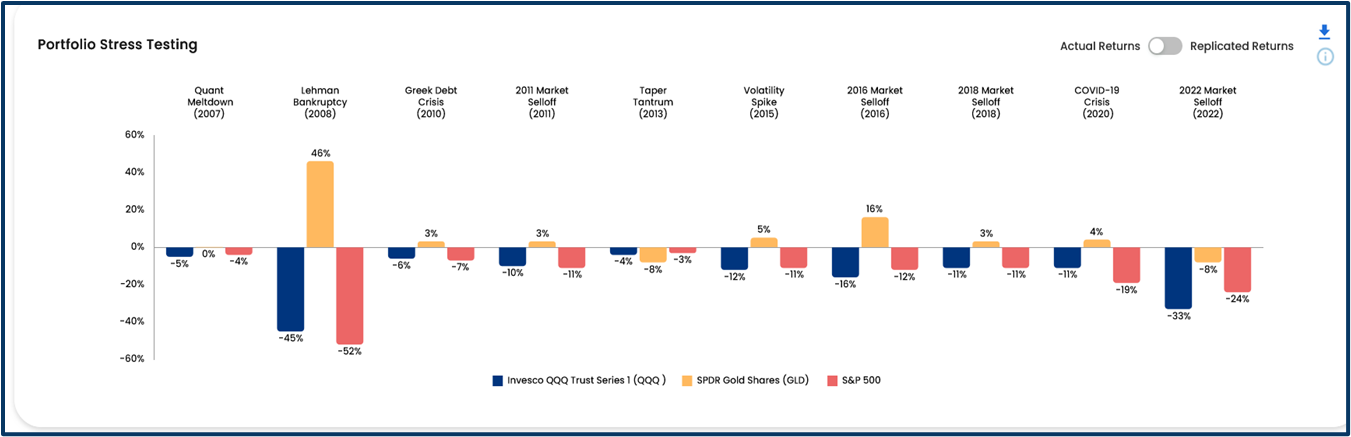

The chart below, from fund research house Finominal.com, shows the performance of gold versus the Nasdaq 100 ETF (QQQ) and the S&P 500 index, during a series of market moving events over the last 18 years.

Source: Finominal.com

Gold outperformed both of these equity benchmarks, at most of these key turning points, and in 2008 and again in 2016, it did so quite handsomely.

Geopolitical Safety

Gold is viewed as a safe haven asset during periods of geopolitical turmoil and uncertainty.

Significant world events like wars, recessions, or political crises often drive investors toward the relative safety of gold.

Yes and no, because gold was relatively unmoved by Russia’s invasion of Ukraine or by the attacks on Israel, last October, that led to the current conflict in the Middle East.

Indeed at the time of writing the gold market seems unconcerned about Iran attacking Israel with a large scale drone and missile strike.

Supply Constraints/ Liquidity and Accessibility

Unlike currencies which can be printed at will, the supply of gold is inherently limited by what is mined from the earth's crust.

This supply constraint, combined with increasing industrial and jewelry demand, suggests gold could continue appreciating over time.

The modern gold market offers excellent liquidity and is accessible to both institutional and individual investors. There are plenty of options including gold ETFs, futures, CFDs, and more.

To some extent these are contradictory arguments, because, whilst its true that physical gold supplies are limited, most of the gold that has been mined throughout history, is still in existence today.

Whilst, the markets in paper gold and gold derivatives, such as CFDs, are open ended, which means that there are no limits to how many contracts can be created.

So why has the gold price recently sprung back to life if not for the reasons listed above?

Well one theory is that it is in response to the explosion in US governement debt and spending.

And in particular to rapid growth in the cost of servicing and refinancing that debt, which will become all the more expensive if US interest rates aren’t cut in the foreseeable future.

That's not yet the markets base case.

However, we have already shifted expectations of the first Federal Reserve rate cut from March 2024 out to September.

And the number of rate cuts expected this year has shrunk from 6 or 7, to just 2 or 3 at best.

Interest payments on US government debt will reach some $870.00 billion this year, according to forecasts from the Congressional Budget Office.

This represents a +32.0% increase over the bill for the prior year and is almost +$50.00 billion more than the US budget for defence spending in 2024.

US debt has grown from $17.00 trillion in 2014, to $33.00 trillion, and rising, today.

So should you be trading gold?

My answer to this is yes but only when its moving.

My view is to be tactical and not strategic, don't fall in love with, or pin your hopes on gold.

Instead look to take advantage of the price momentum, in either direction, within the gold market when it occurs

And don't feel that you need to trade gold itself to do this, for example, my favourite way to play gold this year has been through gold related equities.

One of which has been gold miner Gold Fields (GFI US), which has actually outperformed gold in percentage terms, since early February.

Gold will always hold a fascination for us but we shouldn’t let that cloud our judgement rather we should try and use that fascination to our advantage.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.