When economic conditions, and or, investor sentiment turns sour, volatility can spike and investors and traders often look to defensive stocks as safe havens.

Defensive stocks and sectors are made up of companies and industries that tend to be resistant to recessions and market downturns.

Defensive plays aren't just for uncertain times however

Many investors maintain exposure to defensive stocks as part of a long-term strategy that’s designed to reduce their overall portfolio risk and volatility.

Here's a closer look at what makes stocks and sectors "defensive" and how they can traded.

What Are Defensive Stocks?

Defensive stocks are typically found in mature industries which offer products and services considered as necessities, rather than luxuries or discretionary purchases.

Companies in defensive sectors such as utilities, healthcare, consumer staples and basic materials, tend to have stable revenues and earnings.

And they will often pay dividends regardless of the state of the broader economy.

The reason for that is that demand for those basic necessities remains relatively constant, even during recessions or market crashes.

Why?

Well its quite straight forward,people still need to buy food, household items, medicines, energy, and other essentials, as part of their daily lives.

Companies operating in these spaces may see cyclical ebbs and flows in demand as the economy grows and contracts, but not to the same extent as say, consumer discretionary businesses.

What are the characteristics of defensive stocks and sectors

In addition to consistent demand, defensive sectors and stocks tend to share other characteristics that make them resistant to downturns:

● Steady, predictable revenue and earnings streams

● Lower debt levels and strong balance sheets

● The ability to pay and maintain consistent dividends

● Lower volatility compared to overall markets

● They are often mature, established companies, with durable competitive advantages.

This lower relative risk profile means defensive sectors and stocks can lag behind their peers during bull markets, when investors and traders are willing to take on more risk, in pursuit of higher growth.

However, defensive stocks and sectors, tend to outperform and provide stability when the economic cycle turns and markets correct.

Defensive stocks and sectors oofer investors and traders:

1. Better downside protection in bear markets and recessions.

2. Lower overall portfolio volatility and risk exposure.

3. Consistent income stream from dividends.

Boring? Not so much

While defensive stocks and sectors might seem boring and unexciting, their performance can help stabilise returns over the long run, and limit the impacts of major sell-offs and crashes within a portfolio.

As such they can provide stability and certainty, and money managers will often allocate a portion of their capital to these stocks for that very reason.

On that basis alone their dull and dependable reputation is probably undeserved.

Of course these defensive plays tend to come in to their own in times of uncertainty or when the markets take a turn for the worse.

With heightened tensions in the Middle East and an ongoing correction in US equities happening right now you could argue that now is the time to be looking at these potential safe havens.

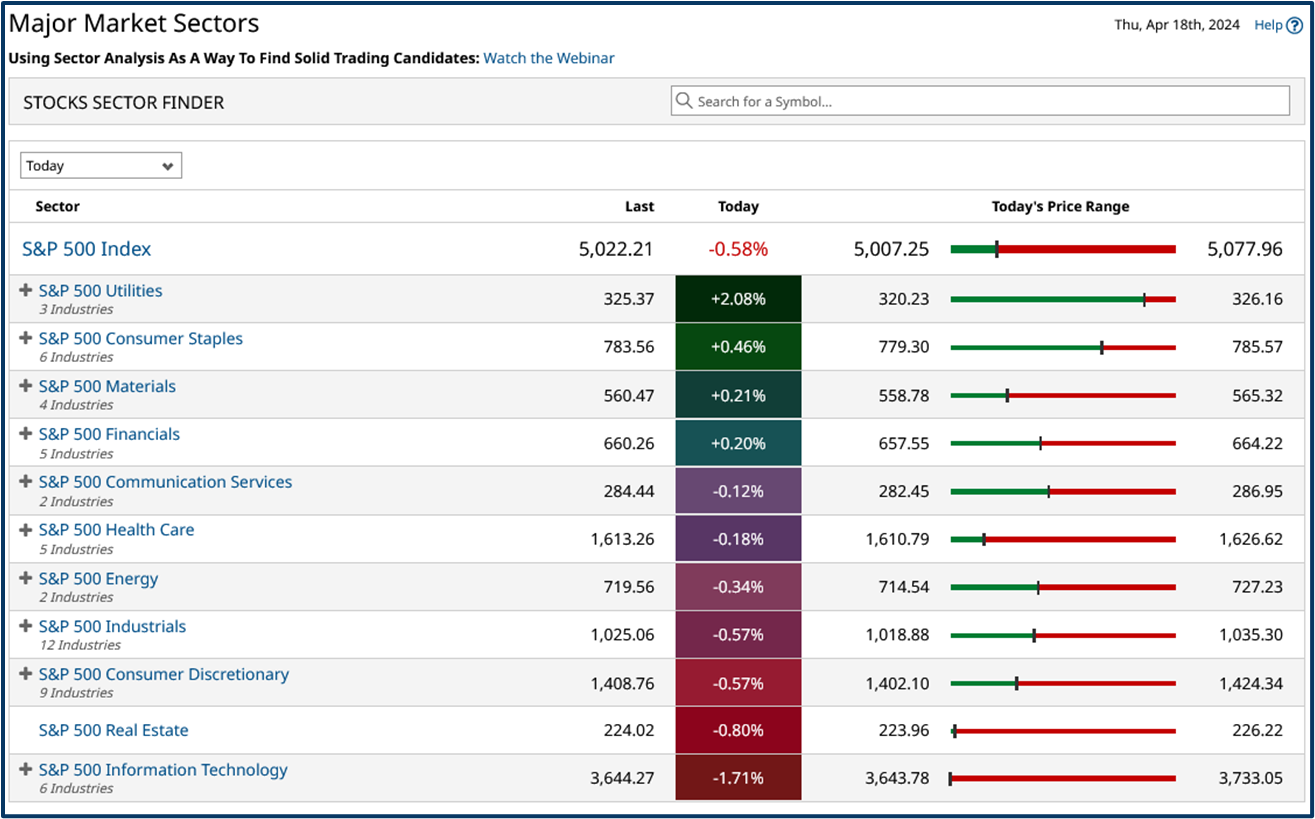

We can see some evidence of a rotation into defensive stocks and sectors in the table below:

Utilities, Consumer Staples and Basic Materials are making gains whilst “growth” sectors such as Consumer Discretionary and Information Technolgy are under pressure.

Source: Barchart.com

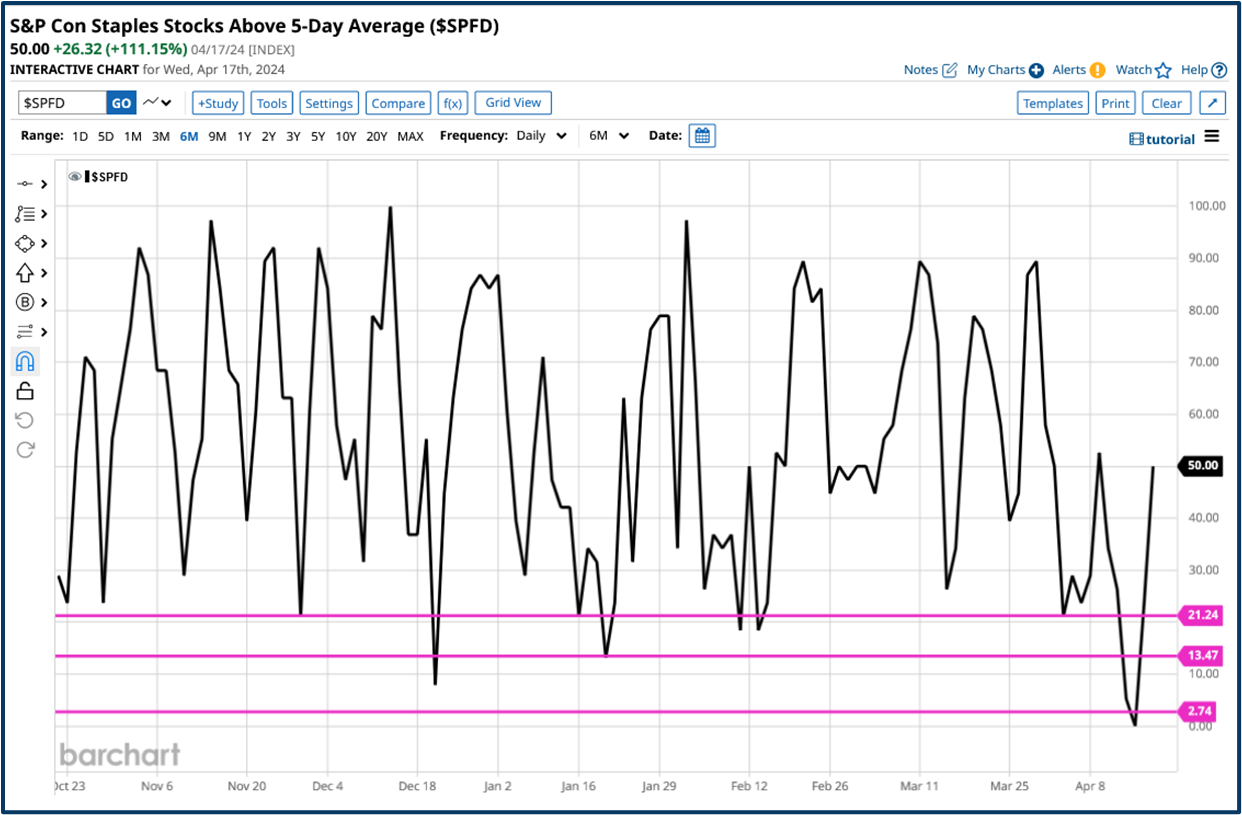

We have also seen a sharp rebound in the percentage of stocks within the S&P 500 Consumer Staples sector that are trading above their 5-day MA lines.

Source: Barchart.com

Defensive sectors have also been outperforming the S&P 500 Intraday as well

The chart shows the S&P 500 index (SPX), the Consumer Staples ($SRCS) and Utility sector's ($SRUT) intraday percentage changes.

Source: Barchart.com

Scope for a bigger correction?

The S&P 500 index has lost around -3.60% over the last week as of the time of writing that’s knocked around a third off of its year-to-date gains but barely made a mark on its 5-year track record of +70.45%.

However, a further fall could be on the cards as we can see in the chart below there is potential for a dead cross in The S&P 500 as the faster-moving 10-day MA line ( blue) closes in on the slower-moving 50-day line (green) from above.

The S&P 500 has been correcting lower breaking both its own uptrend and the 10 and 50 day MA lines.

Source: Barchart.com

If you watched my recent presentation at Round The Clock Trader or read What now for equity markets? You will know that I believe that a change of leadership could be on the cards and with that the possibility of a larger correction in the S&P, perhaps to as low as 4600 in adversity.

It's not nailed on of course, but the market continues to row back its expectations on US rate cuts this year and we have seen leading technology companies, though not US-listed ones thus far, disappoint, as far as earnings and outlook are concerned.

“Forewarned is forearmed” they say and of course in trading failing to prepare is preparing to fail.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.