I have often said that traders need to be pragmatic and adaptable, because market conditions and sentiment can quickly change.

And there is no guarantee that a trading strategy or idea that works today will still be viable in a week's time.

Different markets different trades

The changeability in the markets means that we should have more than one method of identifying trading opportunities.

For myself, I adopt a barbell approach: at one end of the bar I have strategy and systems for spotting short term momentum opportunities.

These types of trades come into view quickly, usually intraday, and can often play out within a session, so they are great for day trading.

Though they can evolve into multi-day trades if there is sufficient interest in the name.

At the other end of the barbell I am looking for longer-term thematic and structural changes.

Which can encompass sectors, stocks and even indices, that have been left behind or have run too far in one direction, relative to their peers.

Which we can think of as longer-term mean reversion opportunities.

There are also opportunities to be had when new information comes to light ,and causes a reassessment of the prospects for a specific stock, sector or index.

Although these two strategies are designed to highlight or identify different types of trading opportunities, over very different timescales, occasionally we find that there is a common theme running through both.

The long and short of it

A perfect example of this kind of trading opportunity cropped up in the last month or so.

You may recall that it mid-April I wrote a piece about the importance of defensive stocks Link

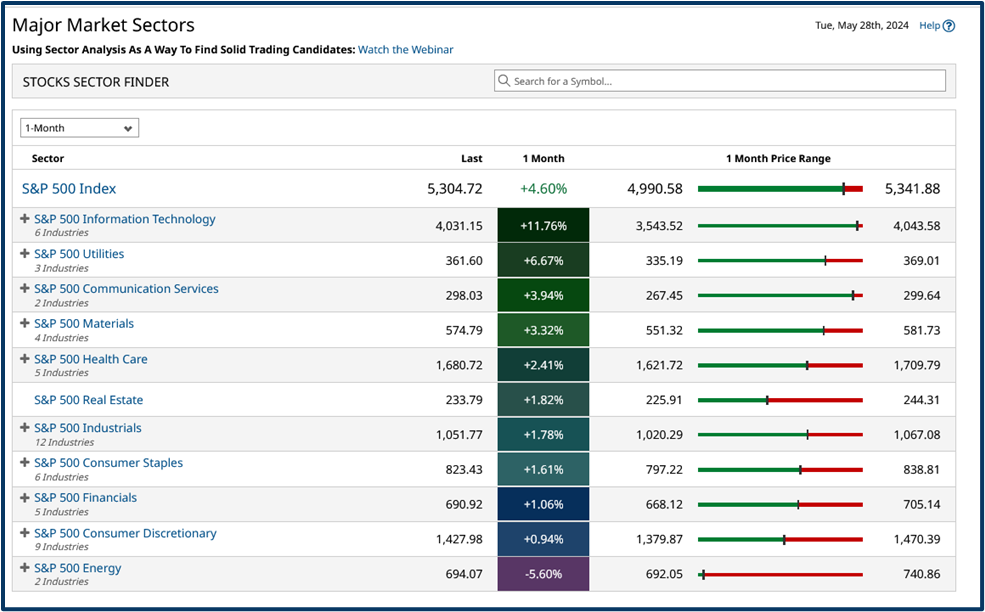

One of the sectors that I highlighted in that piece was the Utilities, which at that point were among the best-performing stocks in the S&P 500. In the previous session, the Utilities had rallied by more than +2.0%, even as the market-leading Information Technology sector sold off by -1.70%.

Source: Barchart.com

The sell-off in technology stocks and the wider S&P 500 proved to be relatively short lived.

However as we can see from the table above, Utilities were the second best performing sector within the broader S&P500, over the last month.

So what exactly was happening here?

After all growth and defensive stocks tend to move in opposite directions, as trader sentiment swings from Risk-on to Risk-off behaviour.

To find out what was behind the Utilities sector gains we need to dig a bit deeper and look at which stocks within the sector made the biggest gains and why.

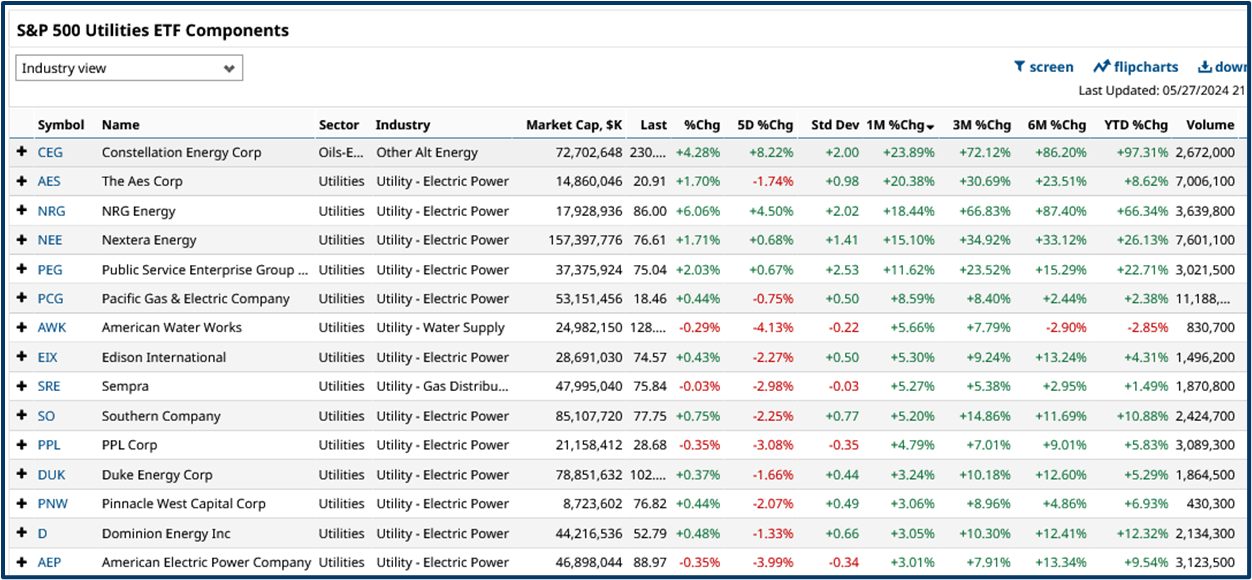

We can do that by looking at a list of the component stocks and ranking them by 1-month percentage change (descending), which I have done in the table below.

To make the task easier, I have also added an industry column into the table.

Source: Barchart.com

As you can see the stocks with the best 1-month performance are nearly all drawn from the Electric Power industry - that is they are electricity generators, or power companies if you prefer.

So why the sudden interest in power generation?

It turns out that the anticipated growth in demand for data centres, created by the ongoing demand for all things AI, has put power companies centre stage.

Running the servers, that drive LLMs and their AI chatbots, is power intensive, and the generators are seen as being likely to benefit from that rapidly increasing demand.

A spillover to the short end

Now, as luck would have it interest in sources of power for data centres also generated some excellent short-term momentum trades recently.

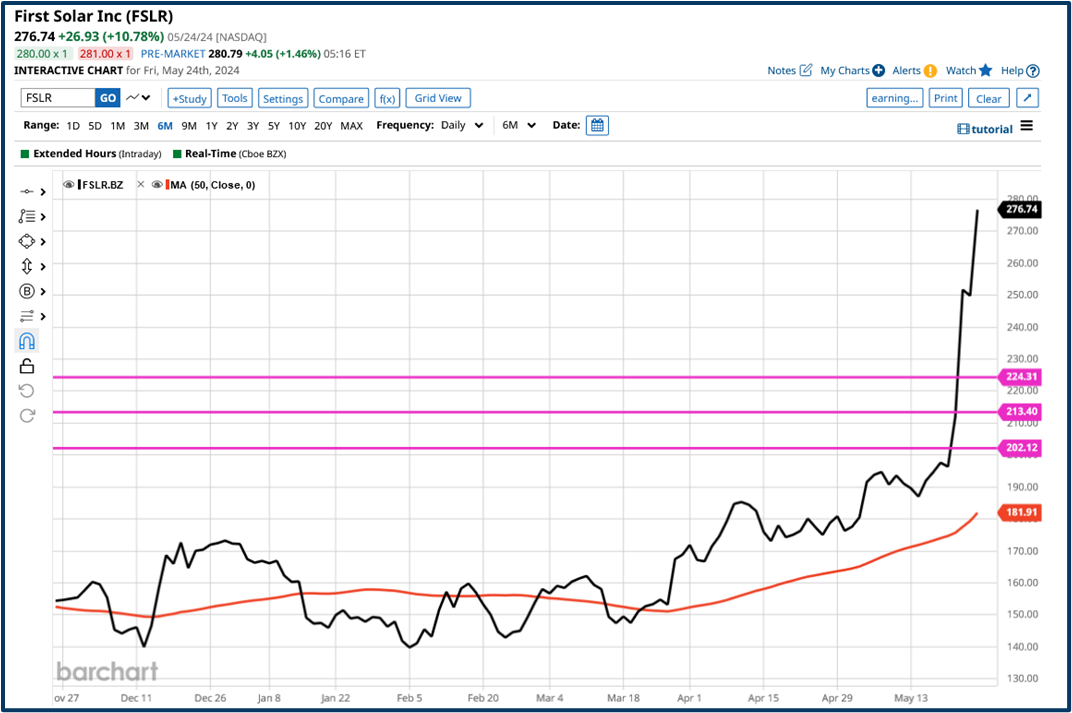

First Solar Inc (FSLR) is a specialist in photovoltaic solar power solutions.

A technology that is seen as key in terms of power generation for data centres, particularly those that want to be as self sufficient as possible, when it comes to their energy needs.

Source: Barchart.com

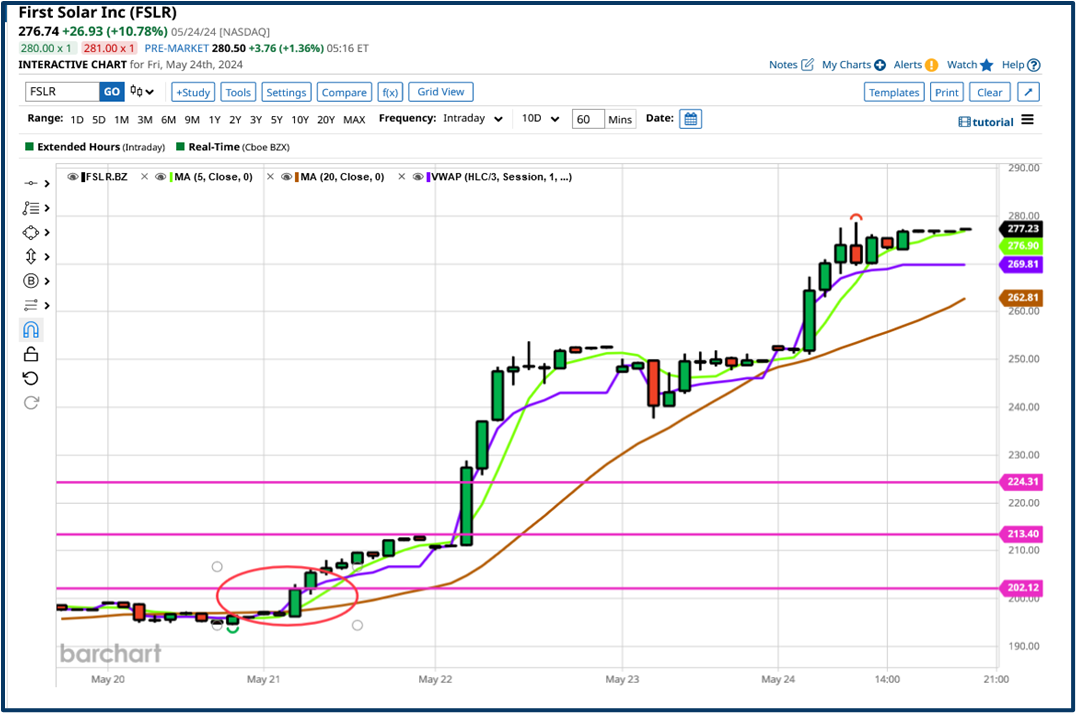

We can see how this shorter-term momentum trade developed, on the hourly chart below.

As price, VWAP and the 5-period moving average, all cross up and through the slower-moving 20-period MA line, on the 21st of May.

We got confirmation of the upside-momentum as the 20-period line started to move sharply upward the following day.

Source: Barchart.com

There were more than $70.00 up for grabs in this move from start to finish with the stock appreciating by +40.0% in a week.

Interest in AI doesn't seem to be going away anytime soon and nor is it likely too

And whilst we haven't yet seen a killer application emerge, we have seen continued gains for suppliers to the industry be they Chip manufacturers, cloud computing providers or power and energy tech companies.

I have often said that we dont need to know the reason something has happened in the market, we merely need to acknowledge that it has and act accordingly.

Yet its important and potentially profitable to have a handle on big-picture themes and the changes and opportunities that they create over different timescales and tradw types.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.