We are now in the fifth month of the year, a time when markets have traditionally slowed down hence the adage

“ Sell in May go away Come back on St Leger Day”

The St Leger is one of the oldest classic horse races in the world and is run in mid-September at Doncaster Racecourse.

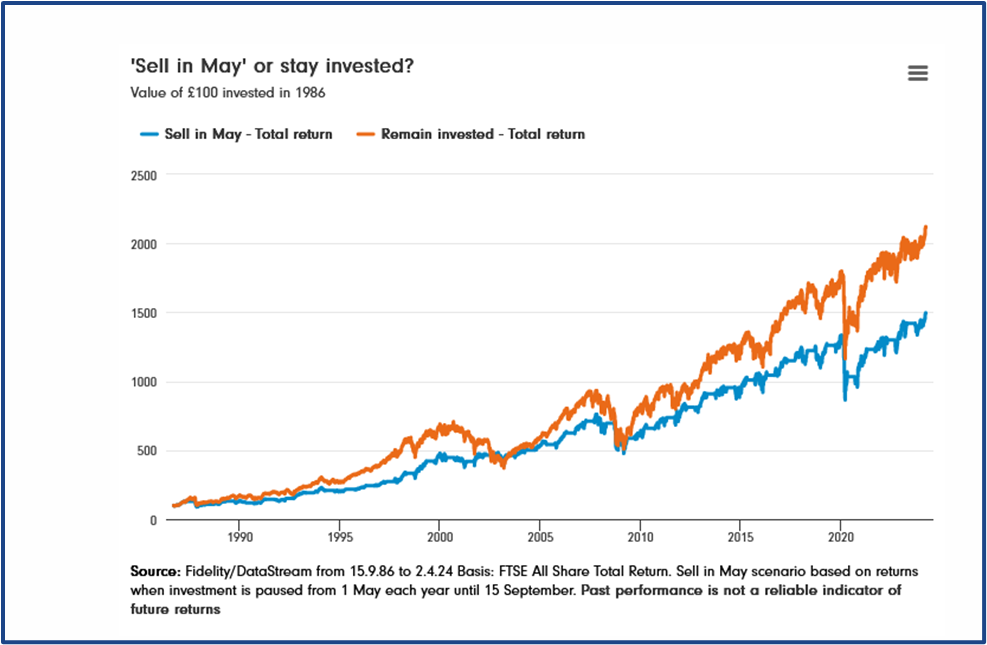

Money manager Fidelity recently looked into the veracity of that saying, and found that since 1986, in the UK at least, selling out of the market in May has been the wrong thing to do, more often than not.

Staying in the market between May and mid-September has produced greater returns than selling out and reinvesting later in the year.

Source: Fidelity

So what does May hold for traders?

Is it time to bank profits on the longs and to look the play the short side of the market?

Or, should we stay as we are, trading the markets with an upward bias?

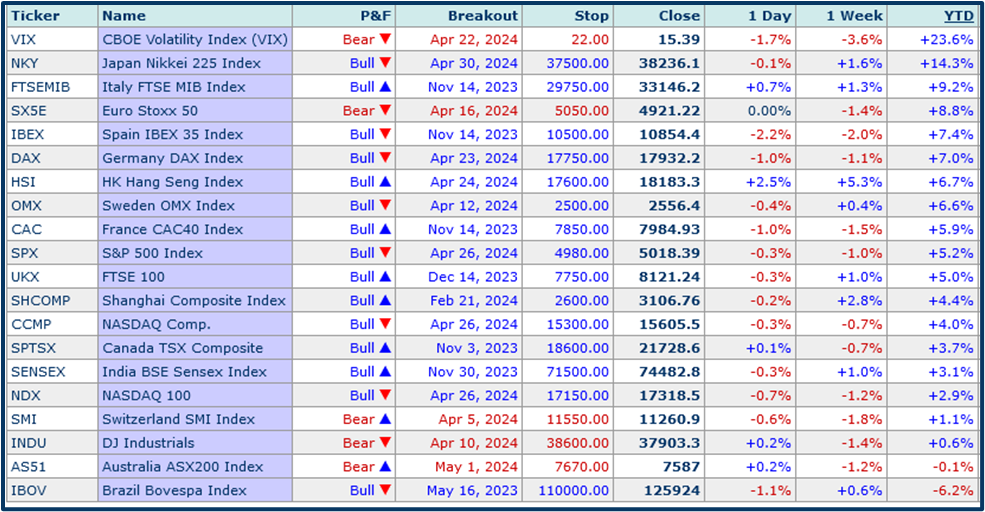

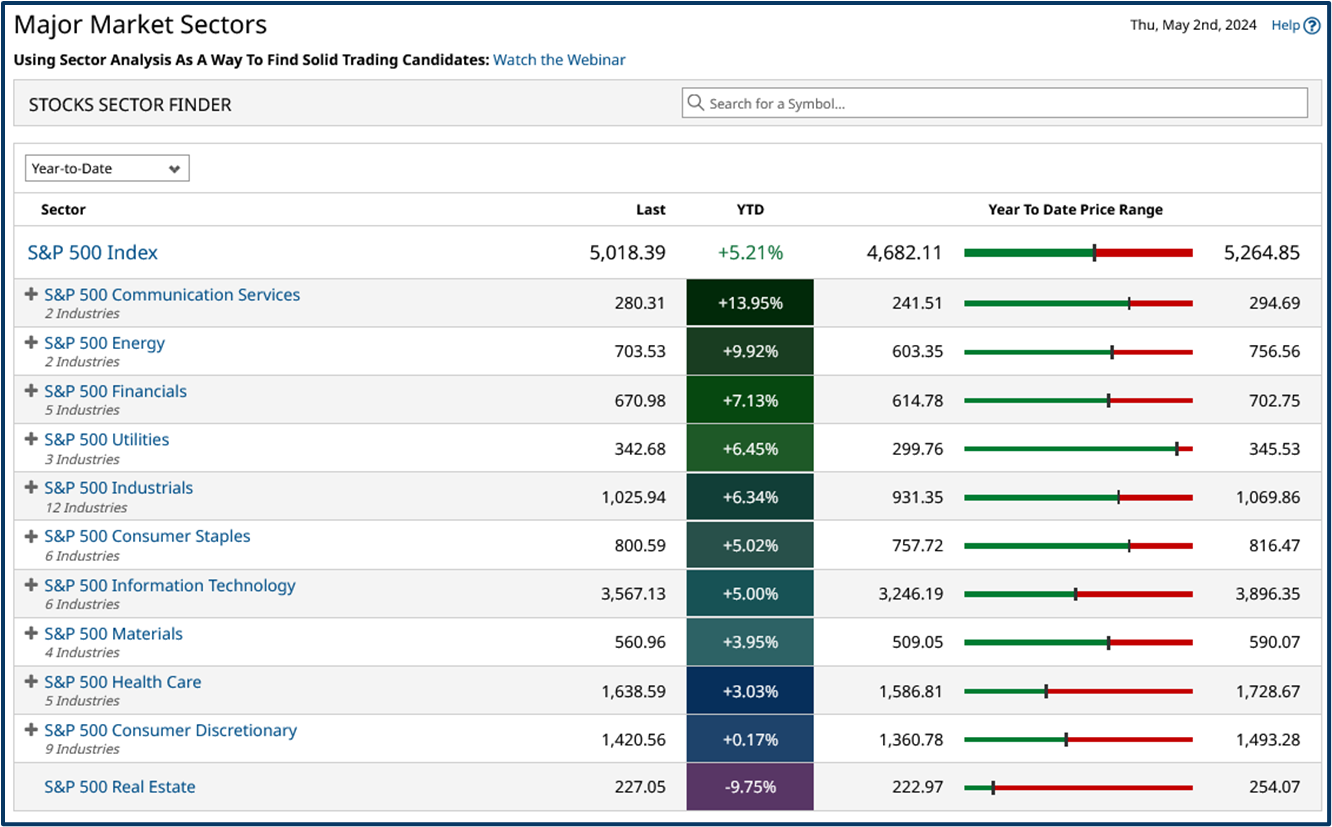

After all, if we look at the table of major equity indices below which is ranked by year-to-date % change descending, we find that most of the constituents are still in positive territory.

However, the fact that the VIX index is the year's biggest gainer, up by +23.60% could be seen as a warning sign, particularly when the Nasdaq 100 is up just +2.90%, after April's sell-off.

Source: Barchart

Defensive Posturing

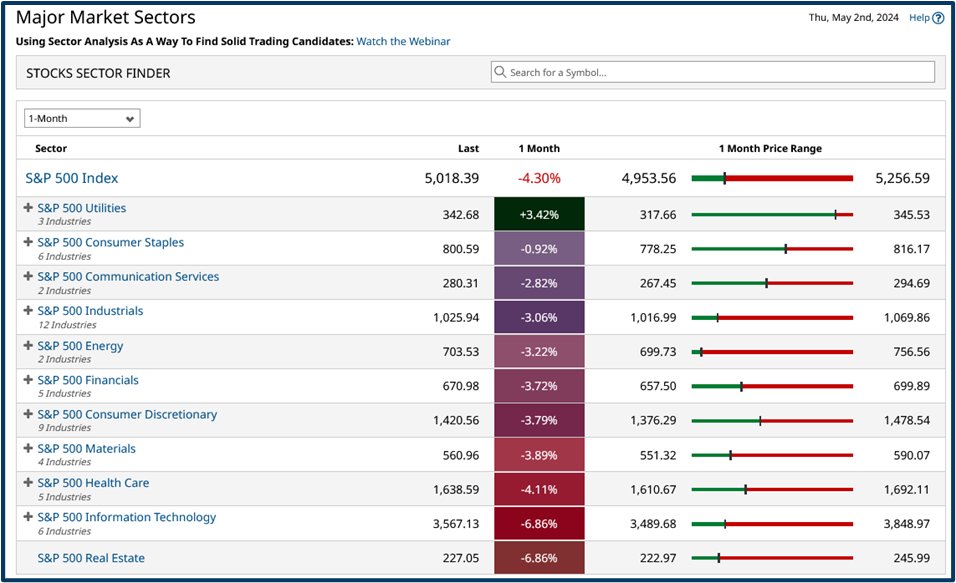

If we examine the performance of the S&P 500, and its sectors in the last month

We find that all but Utilities and Consumer staples finished much closer to their lows than their high point.

Of course, I set out the importance of and attraction to these defensive sectors in mid-April in this Article the fact that two of these sectors have been outperforming suggests that traders are feeling at least partially risk off.

I say partially because according to research from Bank of America flows into equities at the end of April were the highest they had been in the previous 8 weeks. What’s more the bank’s clients turned net buyers for the first time in five weeks.

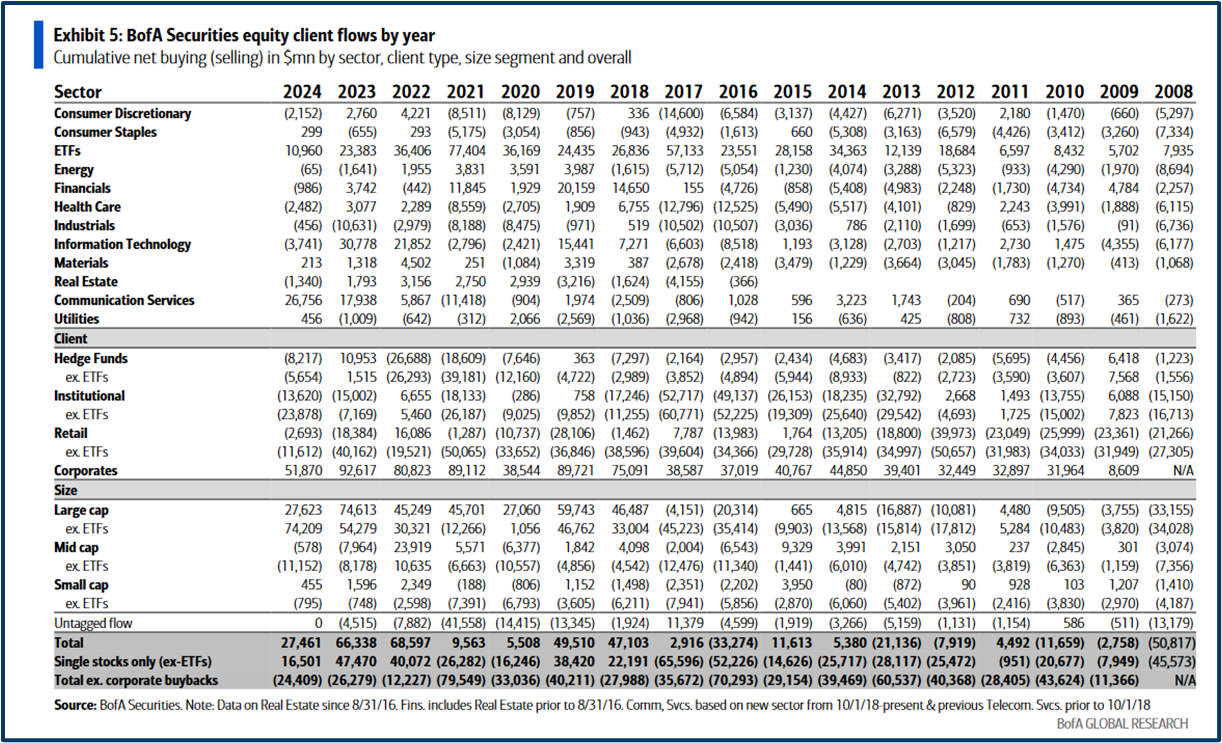

If we look at the table below we can get a feel for where Bof A clients have been putting their money during 2024 to date. The numbers are in millions of dollars and figures in brackets indicate outflows or selling.

Bank of America equity client flows by year.

Source: BofA Research

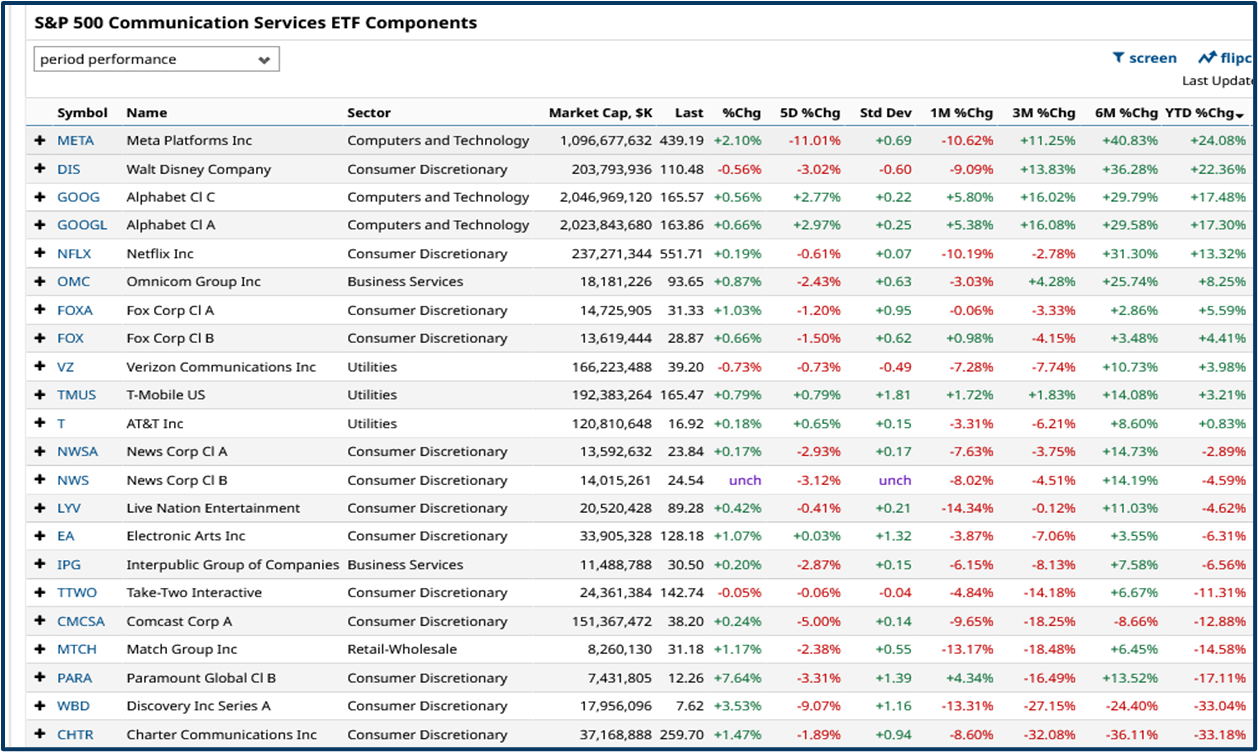

Good Communication

Communications Services have attracted the most investor interest and cash year to date with $26.37 billion being pumped into the sector.

The figures for the first 4 months of 2024 eclipsing the total investment in this sector for all of 2023, by $9.0 billion.

BofA also tells us that clients have bought the Comms services sector in 25 out of the 26, previous weeks.

No surprise then that Comms Services is the best performing S&P 500 sector year to date up by +13.95%.

Source: Barchart

However, if we dig down into the sector we find that it's only 4 or 5 stocks that have made the running it just so happens that several of these are Mega-caps.

Two of which, have added a dividend in 2024, these being Meta Platforms (META) and Alphabet (GOOG) something I looked at in this Article in mid-February. The possibility of a dividend from Alphabet was floated in that article.

Comms Services constituents ranked by YTD % change - Descending

Source: Barchart

Positive Earnings

As of the end of April 46.0% of S&P 500 companies had reported Q1 2024 earnings 77% of those had posted a positive EPs surprise according to data from Factset Research whilst 60% of those reporting, beat on revenues.

And yet the S&P itself hasn’t been able to shake off the recent downward move and as of 01/05/24 remained below its10 and 50-Day MA lines.

Source: Barchart

No rate hikes for now

Fed chair Jay Powell appeared to rule out the possibility of interest rate hikes in the US during 2024 at Wednesday's FOMC meeting but at the same time, he set some high bars, that would need to be met before he and his colleagues could vote for any rate cuts, the window for which is narrowing rapidly.

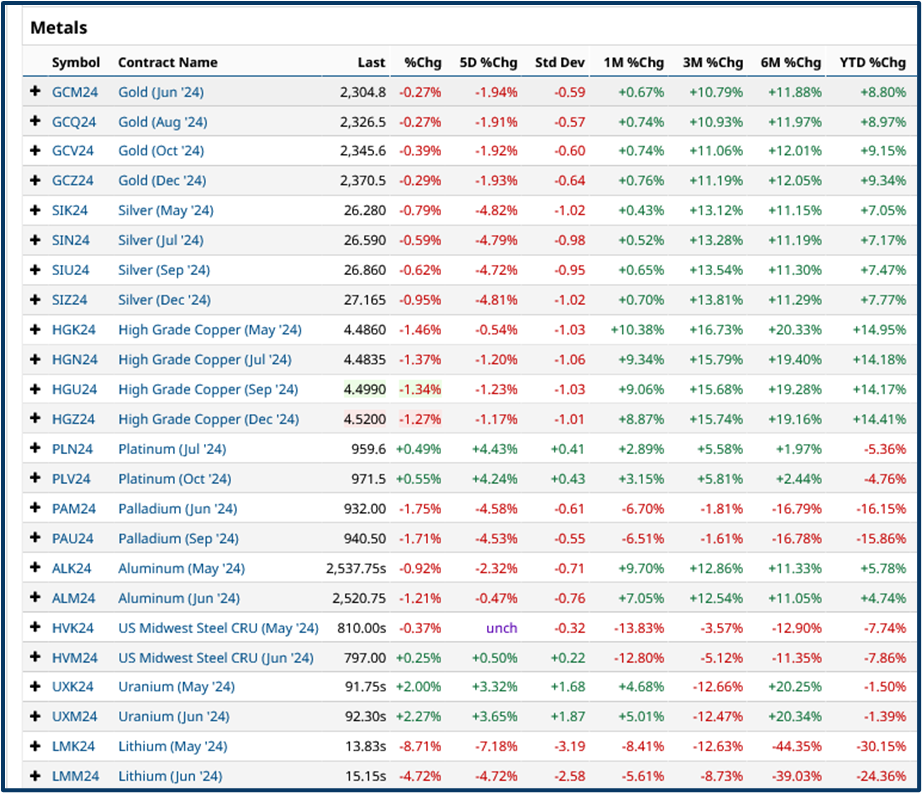

Metal markets have been more subdued in recent days with gold and copper pulling back.

Though both are still up nicely year to date.

Source: Barchart

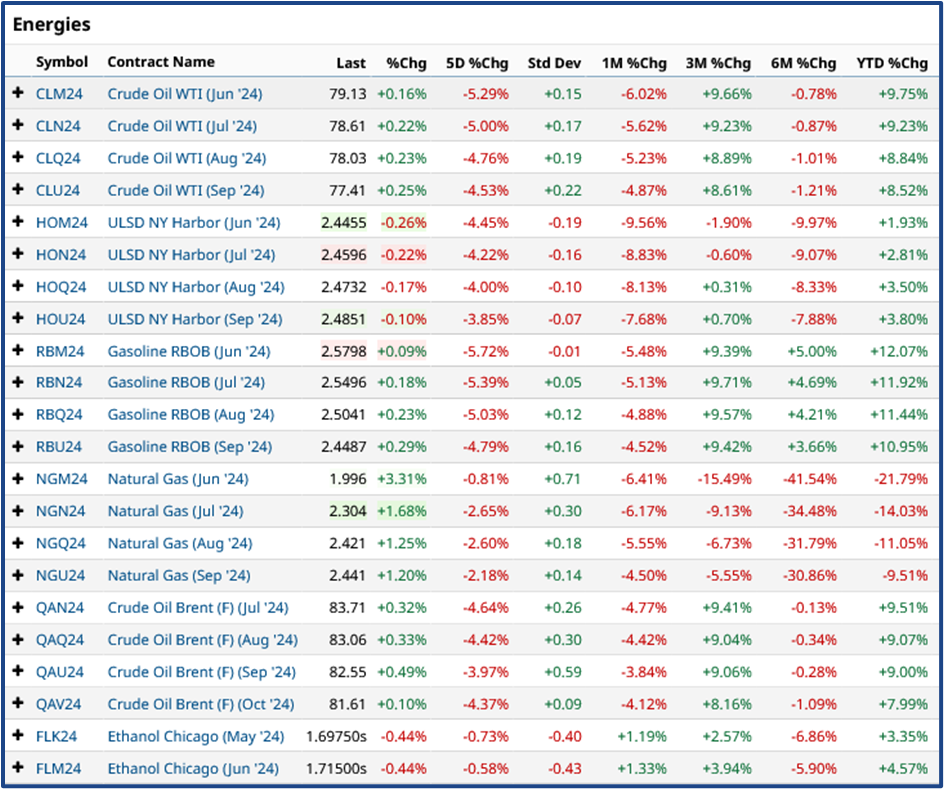

Energy markets have also pulled back, led by WTI crude. The June futures contract, in which, has fallen by -5.29% in the last week.

Whilst US natural gas remains more than -20.00% down year to date.

Source: Barchart

Jobs data could hold the key

Friday, May 3rd will see the release of the April unemployment data.

A weak job creation number could provide a boost for equity markets. However, the last two reports have come in comfortably ahead of consensus forecasts. However, I note that the unemployment rate has started to creep up.

On balance, I think the risk remains on the downside, certainly in the short and medium term.

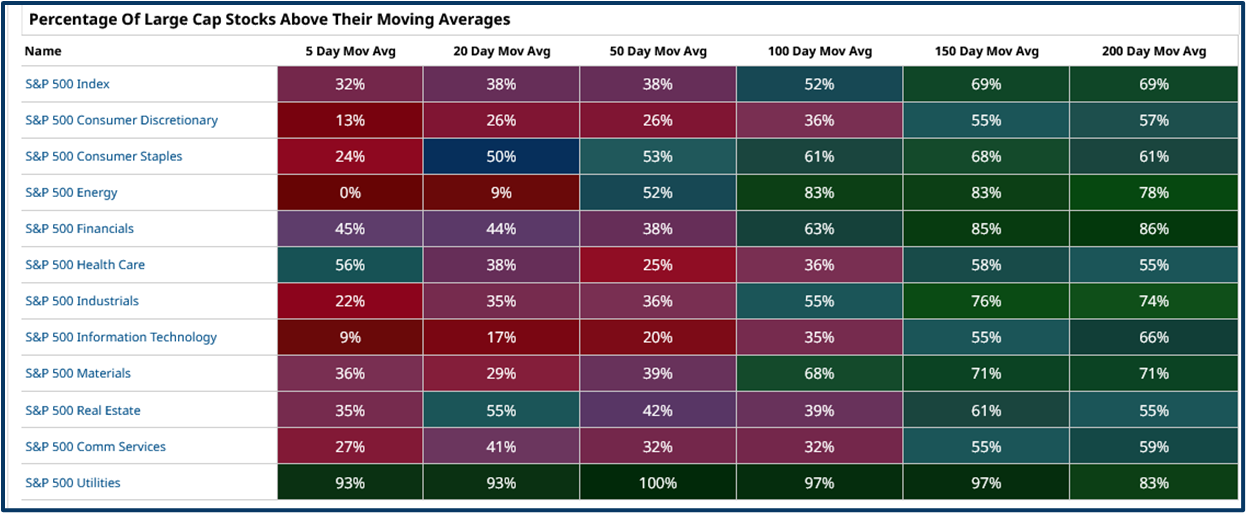

Which we can see reflected in the MA% Heatmap below.

Where there is far too much red for comfort and far too many sectors and time frames with readings below 50.00%.

And until that changes, we should be on our guard.

There is some interest in platinum however which has added + 4.0% in recent sessions.

Source: Barchart

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.