The events of the opening weekend of January were extraordinary; they would have been right at home as the plot of an action movie, or a box set, rather than real life.

The knock-on effects of the US swoop into Venezuela will be felt for a long time to come, and will likely affect every corner of the globe.

In the near term, it is stock, bond and commodity prices that show what participants thought about the US actions, and for the most part, the market reaction was positive.

Although that could change going forward, especially if the Trump administration decides to repeat the exercise, elsewhere in Latin America or beyond.

The S&P 500 was up by +0.64% on Monday, 5th January, the Nasdaq Composite by +0.69% and the Dow 30 by +1.23.%, closing at a record high in the process.

The S&P 500 Energy sector added +2.67%, and is now up +5.93% over the last three months, and just over 8.00% higher in the last 6-months.

That despite a double-digit percentage fall in the price of oil during that time frame.

Time Line

Given the strength of the US Energy sector, I am forced to ask whether we could have predicted what was about to happen, or whether the market knew, or sensed that something was up?

There were signs......

According to Google Gemini:

“Since September 2025, the United States military has conducted a series of lethal kinetic strikes on vessels in the Caribbean Sea and Eastern Pacific Ocean as part of Operation Southern Spear. By the end of 2025, the U.S. had carried out at least 35 strikes on 36 vessels”

Source: Google Gemini

While the origin of those boats was unclear, Venezuela has a significant Caribbean coastline.

President Trump had been escalating, already poor relations between the US and Venezuela, over the last 12 months.

As we can see here:

Escalation Timeline (2025):

January 20, 2025: President Trump signed an executive order designating several Latin American crime organisations, including the Venezuelan gang Tren de Aragua, as Foreign Terrorist Organizations (FTOs).

February 26, 2025: Trump revoked oil production concessions previously granted by the Biden administration and later imposed 25% tariffs on countries buying Venezuelan oil.

August 8, 2025: The U.S. increased the reward for Maduro’s arrest to $50 million, designating him the "global terrorist leader" of the Cartel of the Suns.

September 2, 2025: The U.S. launched a maritime "anti-narcotics" campaign. Over the next three months, more than 30 strikes were carried out against alleged "drug boats," killing over 110 people.

October 15, 2025: Trump confirmed he had authorised the CIA to conduct covert operations inside Venezuela.

November 14–16, 2025: The U.S. deployed the USS Gerald R. Ford aircraft carrier and roughly 12,000 troops to the Caribbean as part of Operation Southern Spear.

December 16, 2025: Trump ordered a "complete blockade" of sanctioned oil tankers entering or leaving Venezuela, claiming the country was "completely surrounded" by U.S. naval forces.

December 29, 2025: The first known direct U.S. strike on Venezuelan soil occurred, targeting a dockyard reportedly used for smuggling.

Source: Google Gemini

Looking at the S&P 500 Energy (oil & gas) sector

I find it interesting that the energy sector rallied even as oil prices fell.

After all, oil supply was rising, and cheaper oil should, in theory, mean that oil company revenues decline, because they get fewer dollars, for every barrel of oil produced.

Of course the possibility to open up and exploit the world's largest oil reserves, which were largely off limits, (thanks to US sanctions), is a once in a lifetime opportunity. I wonder if traders were taking a view based on that (remote?) possibility.

Crude oil (black) versus the S&P 500 Energy sector (pink)

Source:Barchart.com

Not every stock the Energy sector is oil price dependent, however

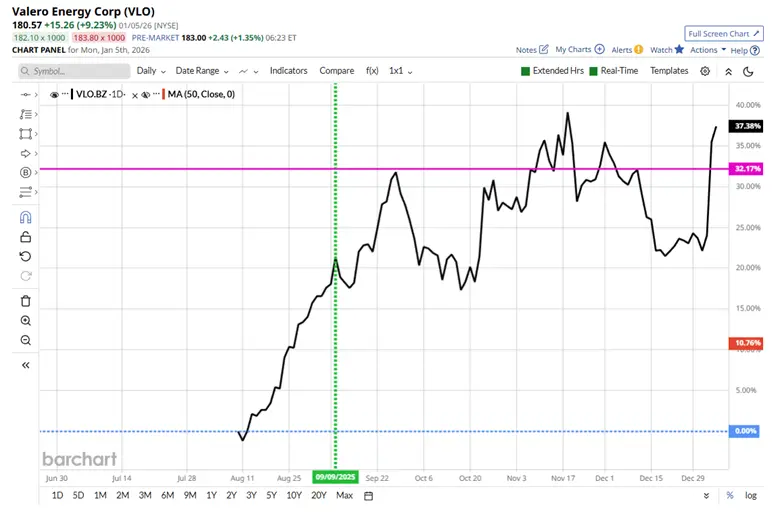

For example, refinery stocks, which tend to be volume or supply focused. O(ne of those is Valero, VLO US.

Valero is a stock that I follow, simply because it can be, and has been a mover.

In fact I highlighted the stock twice in early September on a trading discord I contribute to.

The green dashed vertical line in the VLO chart below, represents the second of those mentions.

It turned out to be a great call.

The stock peaked in mid November, having rallied +37.0% since early August, and sold off in December.

Was that profit taking, and or, traders deciding that action in Venezuela wasn’t going to happen?

We may never know.

Valero VLO US % Change 08-08-2025 to 05-06-2025

Source:Barchart.com

Of course all the above could be pure coincidence, or perhaps it could be explained away with different data and sources.

Despite that I can't shake the feeling that there were clues and opportunities in the Energy sector in this period.

That's one of the reasons I favour a systematic/technical approach to the markets, which I often liken to looking for ripples on the pond.

Ripples, that tell you something could be about to break the surface, even if you don't know what it is.

I think its unlikely that we will ever get to the “truth” of the matter.

However, is the "why" or “ how” even a concern to traders in a situation like this?

If they are in the right stocks, at the right time?

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.