Investing in stock indices provides a gateway to participating in the performance of specific markets and broadening anyone’s investment portfolio through a naturally diversified financial product. The CAC 40, a benchmark index of the Euronext Paris stock exchange, represents the top 40 companies in France.

Let’s take a closer look at the ins and outs of investing in the CAC 40 index, including its composition, its trading hours, why you should trade it, what factors influence its value and why investment strategies or products you should use for exposure to one of the most traded European indexes.

What is the CAC 40 index?

The CAC 40 index, also known as "Cotation Assistée en Continu," is a benchmark stock market index that represents the 40 largest and most actively traded companies listed on the Euronext Paris stock exchange, selected among the 100 largest French companies.

Since its creation in 1987, the CAC 40 is the primary stock index of the French market and serves as a key indicator of the performance of the French stock market as a whole for worldwide investors.

But the CAC 40 index family is quite large, since there are around 40 alternative versions of the CAC 40 to choose from (CAC 40 Cumulative Dividend, CAC 40 Equal Weight, CAC 40 Gross Total Revenue, CAC 40 Net Total Revenue, etc.).

The CAC 40 index is calculated using a free-float market capitalization-weighted methodology, which means that companies with a higher market capitalization (the total market value of a company's outstanding shares) and a larger free float are given more weight in the index. Therefore, the performance of larger and more freely tradable companies has a greater influence on the overall CAC 40 value.

While some sectors have a significant weighting in the index, such as consumer discretionary (30.3%), industrials (21.8%) and healthcare (10.5%), others are only marginally represented, such as telecommunications (1.2%) and real estate (0.3%) - keep reading to find more details about the CAC 40 sectors breakdown. LVMH, TOTALENERGIES and SANOFI, for instance, represent almost 28% of the French index.

Trading Hours

The CAC 40 is traded on the Euronext Paris stock exchange from Monday to Friday from 9am to 5pm Central European Summer Time (GMT+02:00) without any lunch break. If you’re trading the CAC 40, remember that there are market holidays throughout the year that will affect market liquidity and volume, such as Good Friday, Easter, May Day, Christmas and Boxing Day.

CAC 40 Index - Top 10 components as of March 2023 (representing 58.98% of the French index)

- LVMH (MC) = Consumer discretionary = 12.79%

- TOTALENERGIES (TTE) = Energy = 8.14%

- SANOFI (SAN) = Health Care = 6.88%

- L’OREAL (OR) = Consumer discretionary =5.98%

- SCHNEIDER ELECTRIC (SU) = Industrials = 5.28%

- AIR LIQUIDE (AI) = Basic Materials = 4.86%

- AIRBUS (AIR) = Industrials = 4.39%

- BNP PARIBAS ACT.A (BNP) = Financials = 3.69%

- HERMES INTL (RMS) = Consumer discretionary = 3.55%

- VINCI (DG) = Industrials = 3.42%

Portfolio analysis of the CAC 40 by sectors breakdown

- Consumer discretionary = 30.3%

- Industrials = 21.8%

- Health Care = 10.5%

- Financials = 8.7%

- Energy = 8.1%

- Basic Materials = 5.7%

- Consumer Staples = 5.5%

- Technology = 5.0%

- Utilities = 2.7%

- Telecommunications = 1.2%

- Real Estate = 0.3%

How are companies included and excluded from the CAC 40?

Modifications to the composition of the indices within the Euronext Paris stock exchange are determined by the "Conseil Scientifique des Indices".

This committee assesses the components of the various indices in the CAC family every March, June, September, and December, taking into consideration factors such as market capitalization, volatility, liquidity, trading volume, free float size, number of shares, and sector representation within the index. It is also important for CAC 40 companies to have a well-established international commercial and marketing strategy.

While there had been no changes to the CAC 40 since September 2021, on June 8, 2023, it was announced that Edenred would replace Vivendi in the composition of the CAC 40, effective from June 19, 2023.

9 factors that influence the price of the CAC 40

- Local and global economic outlook

- Economic releases

- Euro exchange rate

- Monetary policy decided by the European Central Bank (ECB)

- Company earnings

- Pandemics, war, strikes, and natural catastrophes

- Changes in French legislation or fiscal and tax policies

- Market sentiment

- Speculation

Historic prices of the CAC 40 index

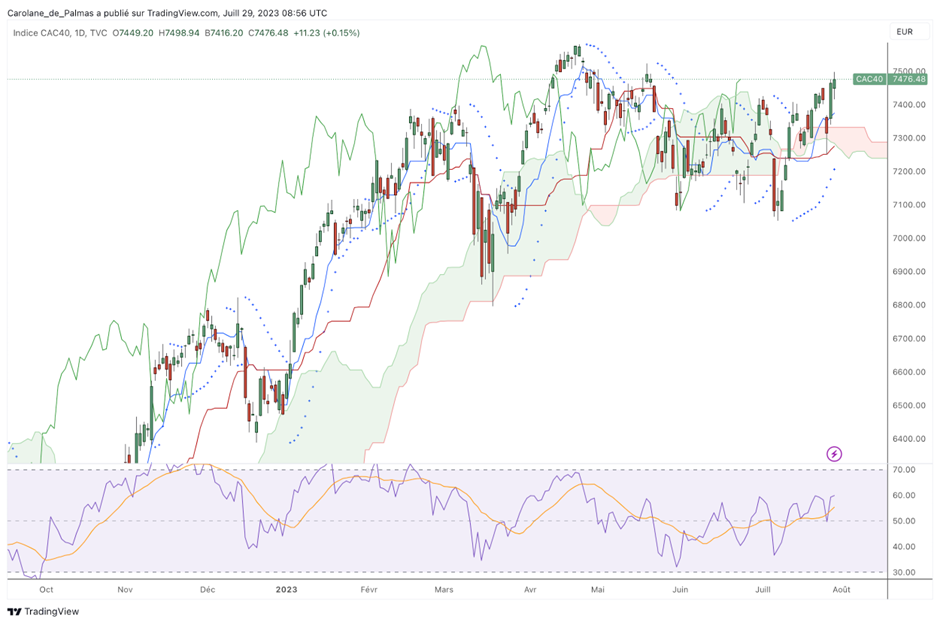

Daily CAC 40 Chart - Source: TradingView (a popular trading platform that powers the online trading software of ActivTrades - the ActivTrader platform)

Why should you trade the CAC 40 index?

Investing in the CAC 40 index provides diversified exposure to the French market through a popular, highly liquid and easily accessible index. It is indeed the most traded index among foreign investors wanting to invest in France, and it is also an index that all brokers provide access to.

France is also one of Europe's largest and most prosperous economies, so trading the CAC 40 offers the opportunity to capitalize on various industries of a powerful country, making it an attractive choice for investors looking for value and diversification.

Index trading is also great for any type of trading strategy, which means that investing in the CAC 40 index is viable for many different types of traders and investors - from those looking to get a relative long term exposure to the French market (swing traders and position traders) to those wanting to trade the CAC 40 over the short-term (scalpers, day traders, swing traders).

How to trade the CAC 40 in 8 steps

- Determine your trader’s profile

- Choose the trading style that best suits you

- Decide the type of strategy to use to trade the CAC 40

- Select the right financial product (ETF, futures, options, CFD)

- Pick the way you’re going to analyze the markets (technical analysis, fundamental analysis, sentiment analysis, quant analysis)

- Write down your trading plan

- Remember to include money and risk management rules

- Take time to opt for the best broker to trade the CAC 40, depending on your trading plan and the best ways to reduce your trading fees.

Other ways to invest in France

In addition to trading the CAC 40 Index, there are a variety of ways to get exposure to the French market if you wish to profit from France’s business dynamics.

You can, for instance, invest directly in individual French companies, use ETFs, other indices from the Paris stock exchanges or sectorial indices, or even invest in French government bonds and corporate bonds.

Another option is to buy an apartment or a house in France, or to participate in the French real estate market via an SCPI or other related financial products without having to own a place over there. You can also participate in the French private equity market if you want to support smaller and younger companies.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.