Competing Narratives

Many narratives were competing for your attention the last few days of December, concerns about the sustainability of the AI trade (bubble?), the possibility of an end to the war in Ukraine, budgetary concerns in the US, Europe and the UK, and the levels of Japanese interest rates and bond yields, to name a few.

However, the one that stood out from the crowd (or at least it did for me) was the sharp and sustained rise in silver prices.

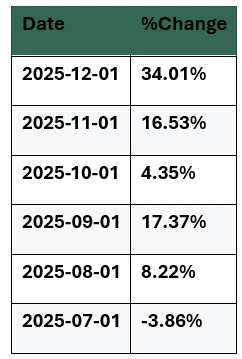

The chart below shows the percentage change in Comex Silver prices over the last month.

The metal effectively rallied by +50.0% between December 22nd and December 28th.

Silver price in $ per troy ounce

Source: Trading Economics

That sharp move higher followed a near +40.0% gain since August:

Silver monthly percentage change since July:

Source: Barchart.com

So what caused Silver prices to go parabolic, and what happens to them now?

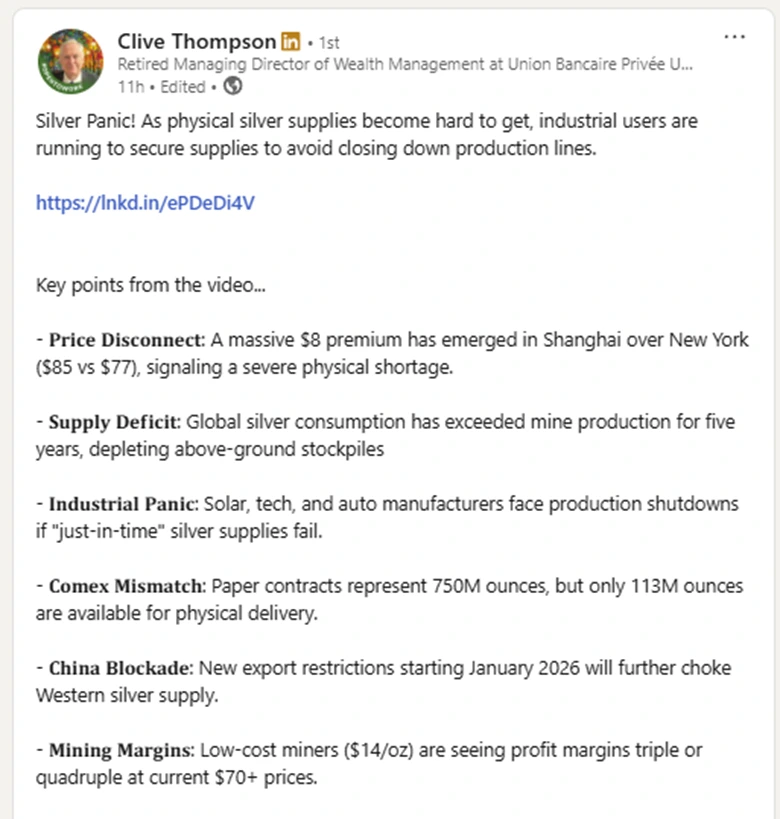

Clive Thompson, the former MD of wealth management at Swiss bank Union Bancaire Privee UBP SA, summed up the market forces that are driving silver prices right now in the LinkedIn post below.

Source: LinkedIn

The key point is that physical supplies are constrained

Commodities are, by and large, traded on Futures markets, allowing producers and consumers to trade against and with each other, the idea being that supply and demand will match off and create price discovery and surety of supply.

However, the majority of commodity futures are traded in a deliverable format, and for silver traders, on the CME's Comex exchange, that means making or taking delivery of 5000 troy ounces of silver, in bars or ingots of 1000 troy ounces each.

5000 troy ounces is the CME silver futures contract size.

As of the time of writing there are around 150k lots of open interest outstanding in Silver futures on the CME, out to and including the July 2026 contract.

That’s the equivalent of 750 million troy ounces of silver.

Silver that traders can’t be certain they can deliver, we can see what happens to prices when traders get nervous about making delivery in the $8.0 premium opened up between silver prices in New York and Shanghai, as traders in China scrambled to cover their short positions. That differential speaks volumes.

Now, of course, the holiday and year-end period is by nature illiquid, when compared to other times of the year, as many participants are on vacation and away from their desks.

And short squeezes are not uncommon in this period, though they often moderate as liquidity and participants return.

And indeed silver has traded down by -5.46% on 29/12/2025 as the squeeze “boiled over “ .

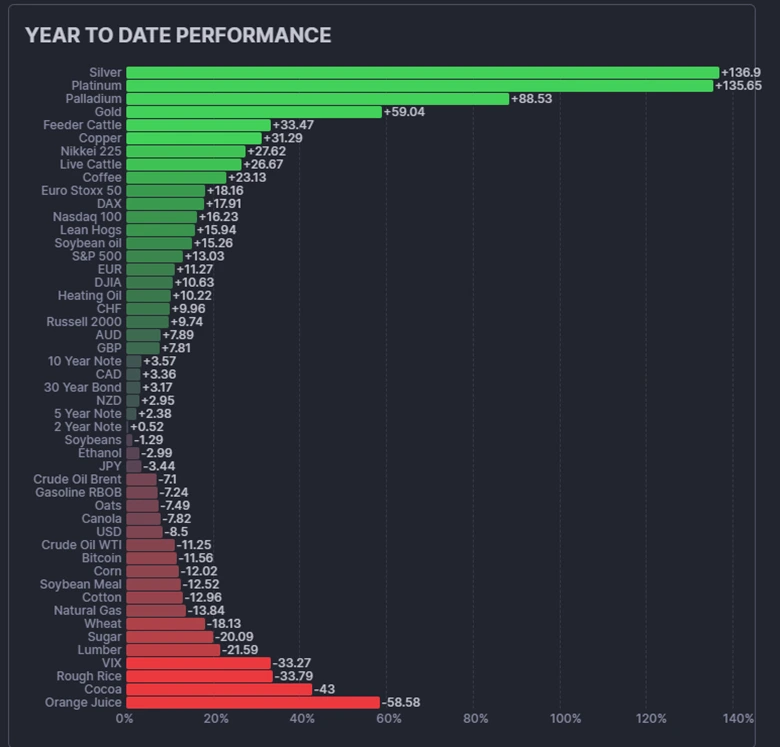

Year-to-date performance

However, if we look at the chart below, which shows the year-to-date performance of various futures contracts, we can see that the whole precious metals group has enjoyed substantial gains throughout 2025.

Source: Finviz.com

Silver prices may well remain elevated thanks to a combination of heightened industrial demand and inadequate levels of silver production.

Of course, higher silver prices aren’t all bad news

Especially if you are a silver miner.

Here is the one-year chart of London-listed miner Fresnillo, FRES LN, one of the world's major silver producers, whose share price rose by more than +400.0% in 2025.

Source: Barchart.com

It's easy to think of silver as a precious metal, or another form of money if you like; however, silver wears two hats, and these days the industrial metal hat is likely the most important of the pair.

Key Industrial Applications and Uses of Silver:

Electronics & Electrical: Silver has the highest conductivity of any metal used in switches, circuit boards (PCBs), connectors, and conductive pastes for heat sinks, essential for high-performance devices, TVs, smartphones, and electric vehicles.

Solar Energy: A vital component in photovoltaic (PV) cells, converting sunlight to electricity, driving growth in renewable energy.

Catalysis: Acts as a catalyst in chemical reactions, particularly for producing ethylene oxide (for plastics, antifreeze) and formaldehyde (resins, adhesives).

Medical: Antibacterial properties are used in wound dressings, catheters, medical instruments, and even in lab coats.

Batteries: Silver is used in long-lasting silver oxide batteries for watches, cameras, and mobile devices, offering more power than lithium-ion.

Water Treatment: Silver’s antimicrobial qualities are used to purify water and preserve food.

Automotive: Used in engine bearings, rearview mirrors (reflective coatings), and rear defrost systems.

Other: Soldering/brazing alloys, pigments (stained glass), and 3D printing inks.

Source: Gemini AI

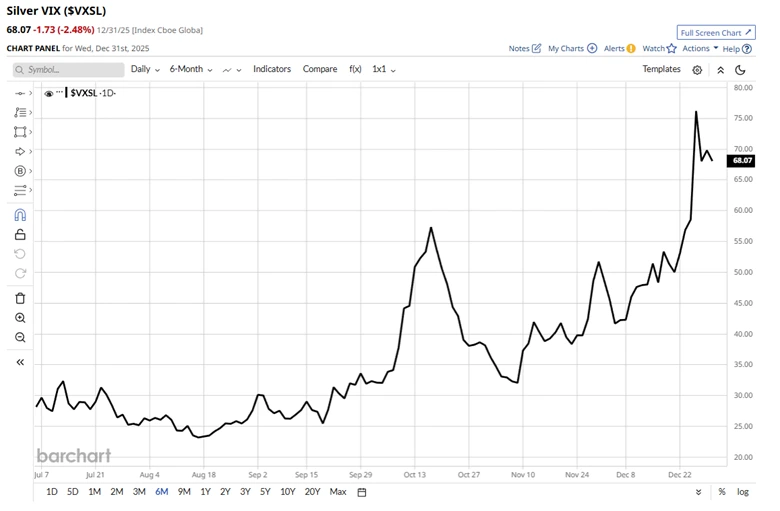

Volatility in silver is likely to remain elevated in the near future

The chart below plots the volatility in silver prices. Think of volatility as a gauge of the tendency of an instrument's price to move violently in either direction.

Silver Volatility briefly spiked to levels above 75.00% that’s an extreme event, though it's more common in physical commodities than other markets.

Source: Barchart.com

There are likely to be plenty of trading opportunities in silver going forward, but in circumstances such as these, it's more important than ever to be disciplined with your risk and money management, and listen to what the market is telling you rather than blindly punting on a price move.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.