In a recent research note that's making waves across financial markets, analysts at Société Générale have thrown down the gauntlet - saying that they no longer expect the Federal Reserve to cut interest rates in 2024.

Instead, their view is that stubbornly high inflation will force the Fed's hand, and that the next move in rates will be higher, rather than lower.

The well regarded cross asset team at the French bank, see no hard landing for the US economy either...

In fact they don’t anticipate any landing at all. Believing instead, that the US will continue to experience economic growth ,avoiding contraction completely.

GDP estimates are picking up

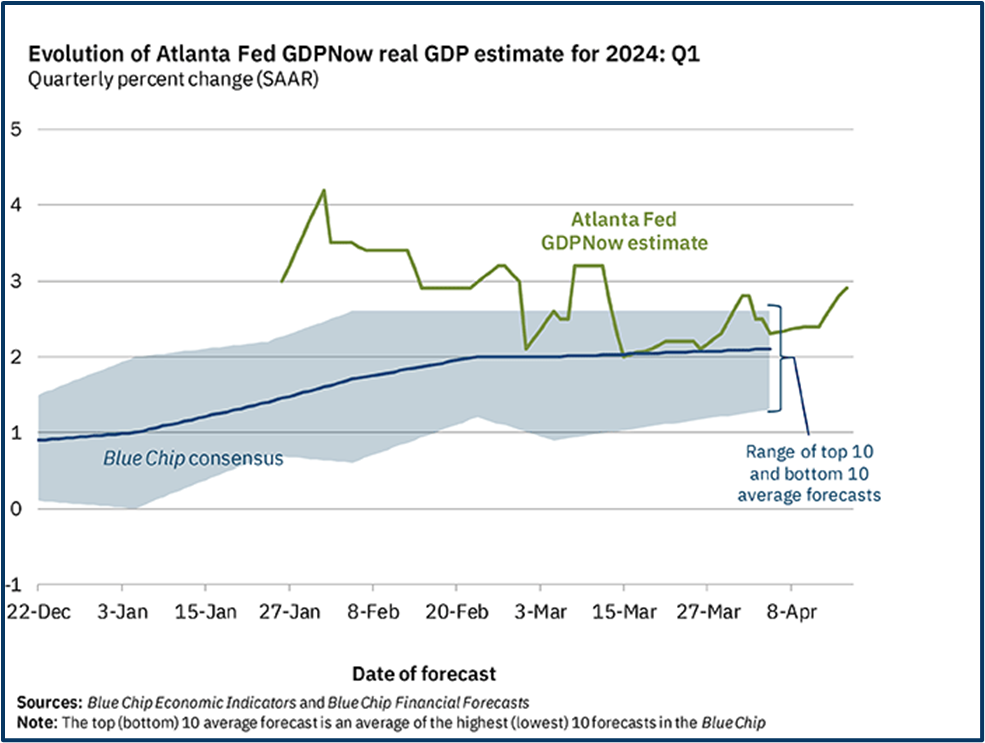

Interestingly the Atlanta Fed’s GDP Now model (which tries to predict US GDP growth by tracking 13 key subcomponents of the data, in near real time) has recently turned higher.

And is now suggesting Q1 2024 GDP growth of just under +3.0%, almost a full percentage point above Wall Streets’ forecasts.

Taking a contra view to the market consensus around rate cuts is a bold call

However, the Soc Gen analysts base their view on hotter-than-expected US inflation data ,and the banks projections for a "no landing" scenario in the US.

By this, they mean an environment in which inflation remains persistent, but the economy avoids a recession.

That's not exactly the "soft landing" scenario that the Fed has been hoping for.

Inflation as a measure of demand

Whilst inflation is often thought of as a measure of price rises, it can also highlight excess demand in an economy some levels of excess demand is essential, if an economy is to grow.

What's important is not so much the outright level of inflation rather it’s the degree of imbalance between demand and supply.

Problems occur when the latter fails to keep up with the former.

With fresh US inflation data due out on Friday the 26th of April we won’t have long to wait until we can see whose right.

So what would higher, and higher-for-longer interest rates mean for US equities?

No Fed easing in 2024 would take some of the wind out of the sails of the S&P 500.

Though in truth the market has been rowing back on its rate cut expectations for some time, and it could probably live with rates staying where they are, for the foreseeable future.

A new upward trajectory for rates would be a different matter entirely, however.

The prospect of falling rates and easier monetary policy has been bullish narrative for equities and one that’s been driving stock market gains, since November at least.

Without the prospect rate cuts to prop up valuations, and earnings multiples, the upside for the major indices could look more limited, or will it?

An alternate take

I say that because there is an alternative viewpoint to which I subscribe.

And that is that the US economy is actually in equilibrium right now.

And that the absolute level of interest rates is not as important as liquidity and access to capital.

True, corporations are probably finding it easier than consumers, and in particular prospective house buyers, who are phased by 7.0% mortgage rates.

However many US house owners have existing mortgages at far lower rates, and at worst that means they are staying put for now, rather than moving.

Earnings season seems to be providing more surprises than disappointments.

And even when figures are poor the market has been able to look through those, if management has a plan to put things right. Tesla TSLA would be the perfect example of this scenario.

Although Meta platforms post earnings performance has provided a counterpoint to that argument.

No swinging to Risk-Off

The cross asset analysis team at Soc Gen isn't looking for a swing to Risk-Off mode either.

Rather they think that higher interest rates will create opportunities for diversification and stock picking between sectors, and investment themes, in what they call dispersion trades.

One trade that the bank believes could be fruitful would be to go long the cash rich Mega Cap stocks.

Whilst at the same time, being short of indebted, or interest rate sensitive, small and mid caps in the Russell 2000 index.

One could argue that this long short idea is already playing out.

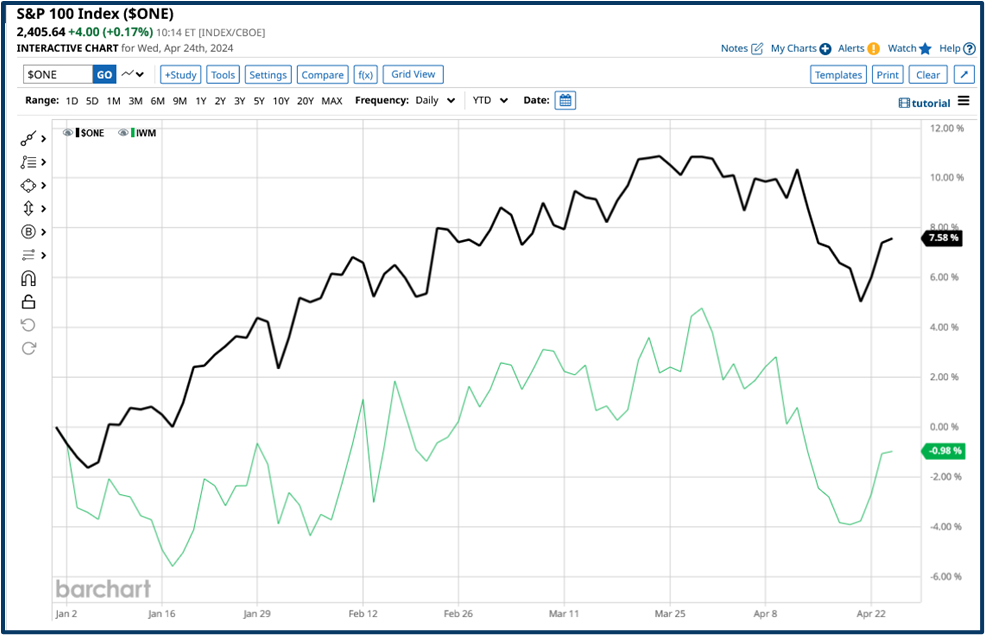

The chart below shows the year to date percentage change in the S&P 100 index $ONE (in black) versus the Russell 2000 ETF IWM (in green).

The differential between the two is more than +8.50% in the Mega Caps favour.

I am quite happy to believe that US rates won't now be cut in 2024. However it's a stretch too far for me to think that they will go higher instead.

Of course we don't actually need that to happen, to see the market react, because if enough people adopt the Soc Gen viewpoint, then it will get priced in regardless.

That kind of behaviour is what gave rise to the old market adage of “ buy the rumour, sell the fact”.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.